Stripe vs PayPal for WordPress payments: How to choose

Trying to decide between using Stripe vs PayPal to accept payments on your WordPress site (or anywhere else)?

Both Stripe and PayPal can be great options for online payments, but there are some differences between the two that might push you in one direction or the other. These are what we’ll try to highlight in this post.

If you’re already using the Gravity Forms plugin to accept payments on WordPress, this comparison will help you make sure you’re using the right payment processor for your situation.

If you haven’t created your first WordPress payment form yet but you’re looking to start accepting payments with Gravity Forms, this guide will help you get off to a good start with your first payment form.

Regardless of your situation, you should have a good idea of some of the important differences between PayPal vs Stripe by the end of this post.

Quick introductions to Stripe and PayPal

Before we get to the more detailed comparison, let’s start things off with some basic introductions to Stripe and PayPal, along with their core focuses.

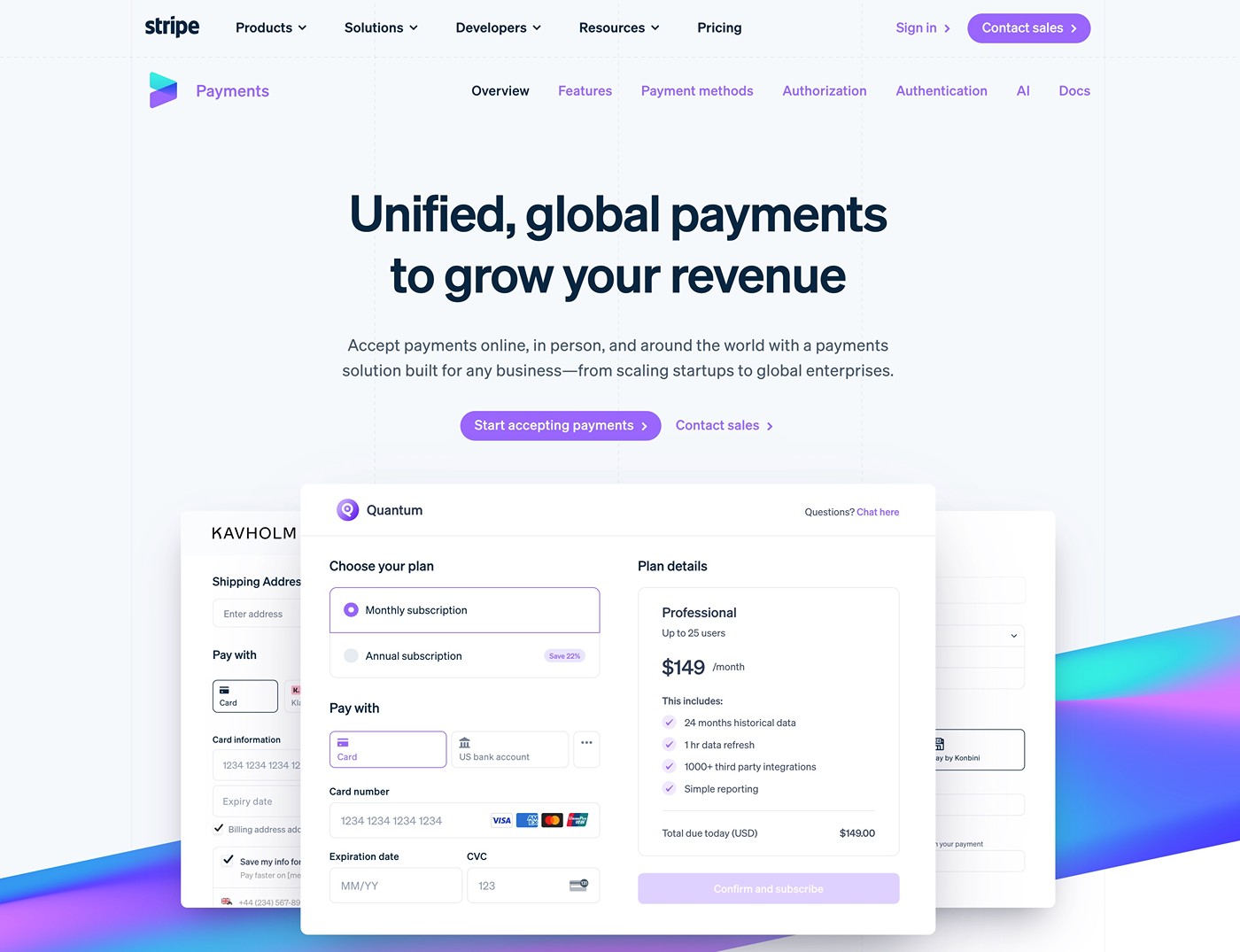

Stripe introduction

Stripe is a financial infrastructure platform that launched back in 2010. Its most well-known offering is a suite of tools to help you accept online payments via credit and debit cards, as well as a ton of other payment methods including digital wallets and bank transfers.

You can integrate Stripe’s online payments API into your WordPress website using something like the Gravity Forms plugin and its Stripe Add-On. Or, Stripe also offers tools to accept payments via links or invoices.

In addition to online payments, Stripe also offers some tools for in-person payments, along with a number of other more sophisticated financial services.

PayPal introduction

PayPal probably needs no introduction as it’s one of the most popular online payment solutions in the world. It was launched in 1998, acquired by eBay in 2002, and then relaunched into a standalone company again in 2015.

While PayPal is best known for offering customers the ability to pay with their PayPal accounts, it also offers a number of other payment and financial services.

For example, PayPal also supports online payments without a PayPal account using card or other methods, including Venmo. PayPal also offers tools for in-person payments via Zettle, a company that it acquired.

Notable features

Next, let’s look at some of the most notable features that Stripe and PayPal offer. Then, we’ll get into more nitty-gritty comparisons such as pricing and rates, supported countries, and more.

Stripe notable features

- Online payments – helping businesses accept online payments is Stripe’s primary focus.

- Support for a variety of payment methods – in addition to card payments, Stripe also supports over 100 different global payment methods. More on these later.

- Subscription payments – you can create automatic recurring payments on a customizable schedule.

- Reporting tools – you can see a bunch of reports about your business’s payments and subscriptions.

- Fraud protection tools – Stripe has built-in protection but you can also use Stripe’s Radar tool to set up your own fraud protection rules.

- Gravity Forms Stripe Add-On – if you’re using WordPress, you can easily create Stripe payment forms using the Stripe Add-On from the Gravity Forms team.

- In-person payments – while in-person payments are not Stripe’s main focus, Stripe does offer some physical hardware and tools to accept in-person payments.

- Tax compliance – Stripe Tax can help with worldwide calculation and collection of sales tax and VAT.

Stripe also offers some more sophisticated tools for advanced use cases, such as a “banking as a service” API called Stripe Treasury, physical and digital cards via Stripe Issuing, and more. However, if you’re only interested in WordPress payments, you won’t need to interact with these more complex offerings.

PayPal notable features

- Online payments – PayPal supports multiple methods for online payments, including credit and debit cards, PayPal balance, Venmo, and a number of smaller local payment methods.

- Pay with PayPal account – you can let people pay using their PayPal accounts rather than entering their personal information.

- Standalone payment processing – while you can let people use their PayPal accounts, you can also let people enter their payment details directly, which means they do not need a PayPal account to make a payment.

- Subscriptions – you can create automatic recurring subscriptions that customers can manage from their PayPal accounts.

- Fraud protection tools – in addition to PayPal’s built-in protections, you can also create your own rules with PayPal’s Fraud Protection tool.

- Reports – you can dig into your business’s online payments using a variety of reporting tools.

- Gravity Forms PayPal Add-On for WordPress – if you’re using WordPress, you can easily create PayPal payment forms using the PayPal Checkout Add-On from the Gravity Forms team.

- In-person payments – PayPal also supports in-person physical payments via Zettle.

In addition to these core features, PayPal also has other tools and services for both small businesses and enterprise organizations.

Pricing, rates, and notable fees

Comparing Stripe vs PayPal pricing can be a bit tricky because there are a lot of different variables.

In this section, we’ll do our best to compare what you might need to pay on a 1:1 basis, including payment processing rates, account fees, and other notable fees – all fees are correct at the time of writing.

Here’s a quick comparison for accepting card payments in the USA to start you off:

|

Stripe |

PayPal |

|

|

Online card payments |

2.9% + $0.30 per transaction |

2.99% + $0.49 per transaction |

|

In-person card payments |

2.7% + $0.05 per transaction |

2.29% + $0.09 per transaction |

Stripe

Stripe charges the following rates for payments in the USA:

- Online card payments – 2.9% + $0.30 per transaction

- Online wallet payments (Apple Pay, Google Pay, etc.) – 2.9% + $0.30 per transaction

- In person card payments – 2.7% + $0.05 per transaction

- Manual card entry card payments – 3.4% + $0.30 per transaction

- ACH payments – 0.8% ($5 cap)

- Stripe Link payments – 2.9% + $0.30 for domestic cards or 2.6% + $0.30 for Instant Bank Payments

This page has more details on Stripe’s USA pricing. Here are Stripe’s pricing pages for some other regions:

Stripe chargeback fees

For disputed payments, Stripe charges a non-refundable $15 fee, regardless of the outcome of the dispute. Most services charge this fee, including PayPal.

Stripe monthly account fees

Stripe does not charge any fixed monthly fee for accepting payments.

However, Stripe does charge some monthly fees for additional services beyond basic payment processing, such as using a custom domain name with Stripe Payment Links.

PayPal

At the time of this post, PayPal charges the following fees for payments in the USA:

- Online card payments – 2.99% + $0.49 per transaction

- PayPal checkout – 3.49% + $0.49 per transaction

- PayPal Guest checkout – 3.49% + $0.49 per transaction

- Pay with Venmo – 3.49% + $0.49 per transaction

- Alternative Payment Method (e.g. Apple Pay) – 2.89% + $0.29 per transaction

- In-person payments (via Zettle POS) – 2.29% + $0.09 per transaction

- Manual card entry card payments – 3.49% + $0.09

This page has more details on PayPal’s USA fees. Here are PayPal’s fees for some other countries:

PayPal chargeback fees

Like Stripe, PayPal charges a nonrefundable fee regardless of the outcome of your chargeback. Currently, this fee is $15 for disputed US dollar transactions.

PayPal monthly account fees

Like Stripe, PayPal does not charge any fixed monthly account fee. You’ll only pay the processing rates for the payments that you receive.

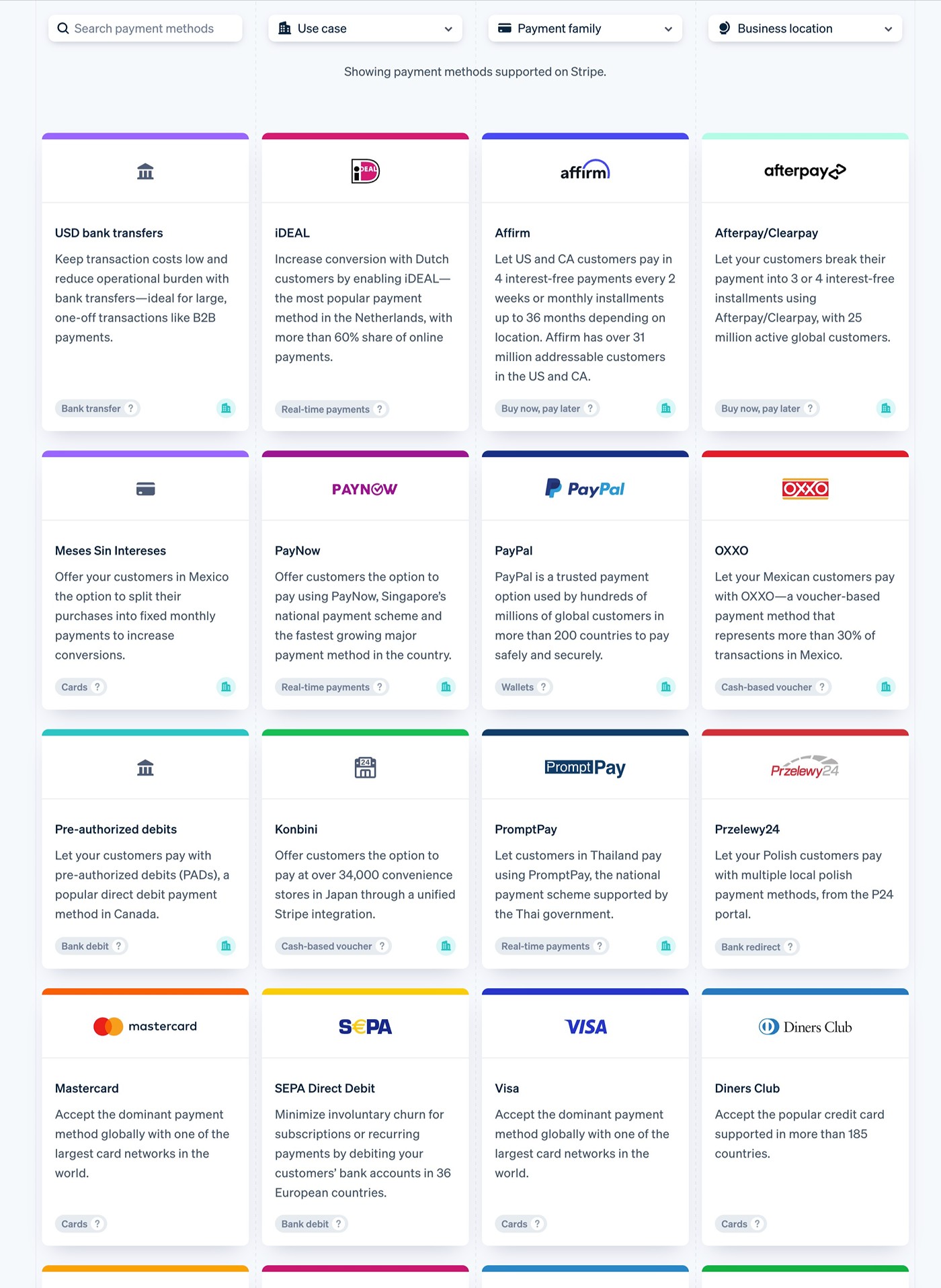

Supported payment methods: Stripe and PayPal

While both Stripe and PayPal let you accept online card payments, both services also support a number of other payment methods, such as digital wallets and local bank transfers.

In general, Stripe offers the broadest payment method support, but PayPal also offers a pretty good selection that includes most popular methods.

If you’re using Gravity Forms to create WordPress payment forms, it’s important to note that the exact payment methods you can choose at Stripe and PayPal will be determined by the Gravity Forms add-on that you’re using. We’ll talk about the Gravity Forms add-ons for Stripe vs PayPal in a later section.

Stripe

One of Stripe’s strong points is that it makes it easy to accept a variety of different payment methods in addition to credit and debit cards.

The exact options that are supported will depend on your chosen currency and location, but here’s a quick summary of the supported options:

- A broader selection of global and local digital wallets, including Apple Pay, Google Pay, WeChat Pay, Cash App Pay, GrabPay, Alipay, and lots more.

- Lots of bank transfer/debit options including ACH payments in the USA, SEPA transfers in Europe, EPS, Bancontact, SPEI (Mexico), and many more.

- Buy now, pay later methods, including Affirm, Afterpay, Klarna, and many others.

As mentioned, not all of these payment methods are supported via Gravity Forms – more on this below, or check the Gravity Forms Stripe Add-On page for supported methods.

Another unique detail is that, in many European countries, you can actually use Stripe to accept PayPal wallet payments as well. However, this option is not currently available in the United States, Canada, Australia, or anywhere else outside of the European Economic Area.

You can browse all of Stripe’s payment methods here.

PayPal

In addition to letting customers pay using their PayPal accounts, PayPal also supports a number of payment methods beyond that, though it still doesn’t match the number of options that Stripe supports.

To start, customers can pay directly using credit or debit cards.

Beyond that, PayPal also supports a decent selection of digital wallets and bank transfer methods:

- Popular digital wallets including Apple Pay, Google Pay, and Venmo.

- Some bank transfer/debit methods including Bancontact, EPS, iDEAL, SEPA, and ACH.

- Buy now, pay later with PayPal Pay Later and Klarna.

Again, not all of these payment options are supported if you’re accepting payments with Gravity Forms.

You can browse all of PayPal’s supported methods here.

Supported countries and currencies

Both Stripe and PayPal support a broad range of countries and currencies. In fact, they’re two of the best options when it comes to global coverage and local currency support.

In general, Stripe offers broader local currency support while PayPal offers account support for a larger selection of countries.

Stripe

At the time that we’re writing this post, Stripe is available in 50+ different countries. It also lets you charge your customers in more than 135+ different currencies and receive funds in your own currency (though there might be exchange fees for certain currency pairs).

By charging your customers in their local currencies, you can avoid subjecting them to foreign transaction fees or suboptimal exchange rates. Not only is this a customer-friendly thing to do, but it can also improve conversion and authorization rates.

You can go to these pages for more details:

PayPal

At the time that we’re writing this post, PayPal is available in over 200+ countries and supports payments in more than 25 currencies.

You can go to these pages for more details:

Gravity Forms add-ons

If you want to accept payments on WordPress, Gravity Forms offers its own official add-ons for both Stripe and PayPal. You can use these add-ons to create customizable payment forms that process one-time payments or set up recurring subscriptions using your choice of Stripe or PayPal.

Below, we’ll take a look at some of the key features in both of these add-ons.

In addition to the payment-specific features that we’ll cover, it’s also important to note that both of these add-ons work with all of the other features in Gravity Forms, including core features like conditional logic and most other add-ons.

For example, you could create a WordPress user account for a person after they make a payment or subscribe them to your email marketing service after they submit the form.

Stripe Add-On

The Gravity Forms Stripe Add-On is available on the Pro, Elite, and Nonprofit licenses.

With it, you can accept one-time or subscription payments via cards, as well as many of the other payment methods that Stripe supports – although some of these will need to be enabled within your Stripe acount. Here are some of the non-card methods that you can accept:

- Apple Pay

- Google Pay

- WeChat Pay

- ACH Direct (bank transfer payment in the USA)

- SEPA Direct Debit

- Bancontact

- EPS

- iDEAL

The exact payment methods that are available to your form will depend on your selected currency and region.

Here are some of the other core features of the Stripe Add-On:

- One-time payments – you can use any of the payment methods listed above, as well as Stripe Link.

- Subscription payments – you can customize the billing schedule according to your needs.

- Free trials and one-time setup fees – you can also offer free trials before subscription payments start and/or charge a one-time setup fee that only applies to the first billing cycle of the subscription.

- Customer self-management for subscriptions – you can create a frontend area on your site for customers to manage their own subscriptions.

- WordPress dashboard payment management – you can also manage payments from the backend WordPress dashboard, including refunding payments or canceling a user’s subscription.

- Authorize and capture – you can authorize a person’s card when they submit the form but wait to actually capture the payment until later.

Beyond that, Gravity Forms also has its own Stripe app that you can install at Stripe to view form details inside the Stripe dashboard.

To see it in action, check out our ultimate guide to using Gravity Forms with Stripe.

PayPal Checkout Add-On

The Gravity Forms PayPal Checkout Add-On is also available on the Pro, Elite, and Nonprofit licenses.

It supports a few different methods for accepting payments using PayPal:

- PayPal Checkout – customers can pay using their PayPal accounts rather than needing to manually enter card details.

- Direct card entry – customers do not need a PayPal account to make their payment. They can just enter their card details directly.

- Venmo – you also have the option to accept payments using Venmo, which is unique to PayPal.

- Buy Now Pay Later – customers can pay in installments while you get paid up front, at no extra cost to your business.

- Country-specific payment methods – once enabled, PayPal determines which sources are appropriate for your particular customer.

Beyond support for those payment methods, here are some other key features of the PayPal Checkout Add-On:

- One-time payments – you can accept one-time payments using any of the methods above.

- Subscription payments – you can customize the billing schedule and also choose whether to have it recur until canceled or automatically stop after a certain number of billing periods (great for payment plans). Note – you can only accept subscriptions via PayPal Checkout, which means that customers will need a PayPal account for subscriptions.

- Free trials and one-time setup fees – like Stripe, you can offer free trials for subscriptions and/or charge one-time setup fees that only apply to the first payment.

- Authorize and capture – you can authorize a person’s card when they submit the form but wait to actually capture the payment until later.

- WordPress dashboard payment management – for one-time payments, you can refund a customer’s payment directly from your WordPress dashboard.

To see it in action, check out our ultimate guide to Gravity Forms and PayPal.

In-person payments (physical hardware)

Both Stripe and PayPal also offer solutions for in-person payments. This can be useful if your business needs to process in-person payments in addition to payments on your WordPress website, as you can still use one service for everything.

However, while both services are capable enough, neither service has a major focus on in-person payments.

If in-person payments are a big part of your business, you also might want to consider Square as another option. We have posts comparing Stripe vs Square and PayPal vs Square if you’re interested in learning more. You can also use the Gravity Forms Square Add-On to accept WordPress payments in addition to in-person payments.

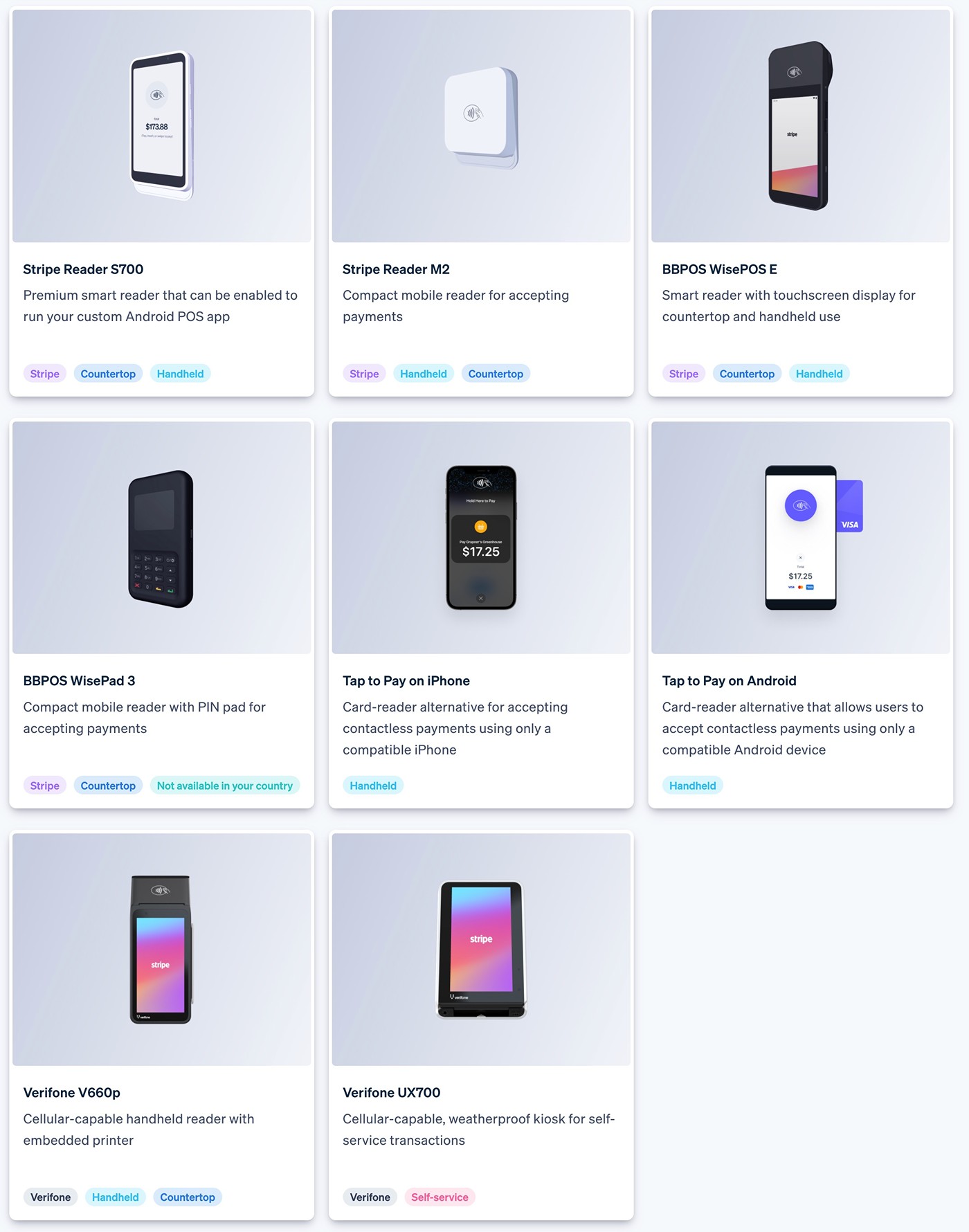

Stripe

While Stripe is primarily focused on online payments, it does still offer physical hardware that you can use to accept in-person payments via cards and other supported methods.

In addition to integrations with some third-party devices from Verifone, Stripe offers two of its own hardware offerings:

- Stripe Reader M2 – a very compact mobile card reader

- Stripe Reader S700 – an Android-based reader that works for both countertop and handheld use.

Stripe also offers its own iOS and Android apps that let you accept contactless payments using any smartphone.

If you want to integrate Square’s hardware into your entire POS system, you’ll need to use existing POS software that integrates with Stripe or code your own custom solution using Stripe’s Terminal API.

PayPal

PayPal offers a few different solutions for in-person payments.

First, you can use QR codes that let customers pay directly using the PayPal app.

If you want to accept card payments directly, PayPal also offers physical hardware and point of sale systems via Zettle, a service that PayPal acquired back in 2018.

Zettle offers a small mobile card reader that you can sync with a smartphone app as well as a full Terminal that doesn’t require any additional connections. Both tools let you accept card payments and contactless payment methods.

Start accepting payments today

If you want to accept online payments with WordPress and Gravity Forms, both Stripe and PayPal are excellent options.

They’re both well-established and trustworthy, while also offering competitive rates, broad country support, and all of the core features most businesses need.

Choosing the right option for your business really just comes down to your own particular circumstances.

If you don’t need to offer customers the ability to pay with their PayPal accounts, Stripe could be the better option.

Stripe offers slightly lower processing rates for online payments, as well as broad support for not just card payments, but also a variety of digital wallets and local payment methods. What’s more, you can also access a lot of these methods via the Gravity Forms Stripe Add-On.

On the other hand, if you value giving customers the ability to pay using their PayPal accounts (and/or Venmo), that would obviously push you in PayPal’s direction. Some types of customers still really put a value on paying with their PayPal accounts rather than entering their details directly. If you have a lot of those people in your target audience, it could be important to give them the option to pay with PayPal.

Either way, Gravity Forms can help

Regardless of whether you use Stripe or PayPal, the Gravity Forms plugin makes it easy to create WordPress payment forms to accept one-time or recurring payments.

The Gravity Forms Stripe Add-On and PayPal Checkout Add-On are both available on the Gravity Forms Pro license and above. If you’re already holding one of those licenses, create your first payment form today by following our guide to WordPress payments.

If you’re not yet holding a Gravity Forms license, purchase your license here to get started with WordPress payment forms.

If you want to keep up-to-date with what’s happening on the blog sign up for the Gravity Forms newsletter!