Plaid vs Stripe: Which fintech platform should you use?

Not sure about the differences between Plaid vs Stripe and which service you should use for your business?

While there are some similarities between Plaid and Stripe, it’s important to understand that they’re still fundamentally different services in many ways.

If you want to make the right choice for your business, you need to understand what these differences are, which is the purpose of this post.

Below, we’ll compare Plaid vs Stripe in a few key areas:

- Basic differences in approach

- Supported payment methods

- Supported countries and currencies

- When you should use each service

If your business uses WordPress, we’ll also cover your options for integrating these services into your WordPress website, including how you can create WordPress payment forms using the Gravity Forms plugin.

The basic differences in approach between Plaid vs Stripe

As we mentioned in the introduction, there are some fundamental differences in approach between Plaid and Stripe. Let’s go through them…

Plaid

Plaid is a fintech platform that’s built around accessing and verifying bank account data.

Businesses can integrate Plaid into their own platforms to make it easy for customers to connect their bank accounts. Businesses can then use this connection to verify bank account information and other financial information, import transaction data, and more.

Customers can also access a secure way to share bank information with apps and services that they’re using. For example, many B2C budgeting and net worth tracking tools use Plaid so that customers can securely connect their financial accounts for automated transaction and balance tracking.

While payment processing is not Plaid’s core focus, Plaid does support bank transfer-based payments. However, it does not offer payment processing for other methods such as cards, digital wallets, etc.

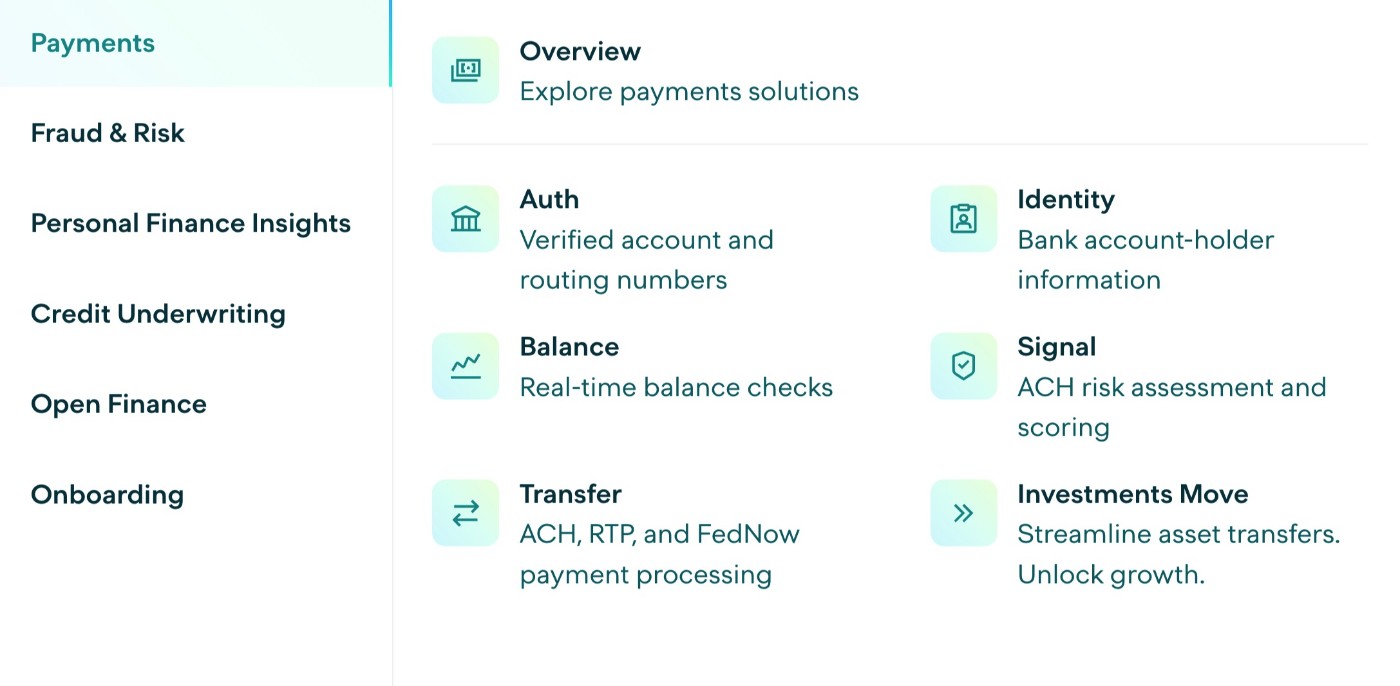

On its website, Plaid divides core product offerings into the following categories:

- Payments

- Fraud and risk

- Personal finance insights

- Credit underwriting

- Open finance

- Onboarding

Stripe

Whereas payments are a small part of what Plaid offers, payment processing has always been one of the primary functions of Stripe.

Stripe helps businesses process payments via credit and debit cards, along with a variety of other payment methods, including digital wallets, bank transfers, “buy now, pay later” services, and more.

Stripe is also built in a very open, API-first way, such that businesses can easily integrate Stripe’s payment processing into their own platforms. In addition to online payments, Stripe also offers physical hardware to help businesses accept in-person payments.

You can also find many solutions that eliminate the need to work directly with Stripe’s API. For example, if you’ve built your website with WordPress, you can use the Gravity Forms plugin and its Stripe Add-On to create one-time or recurring payment forms without requiring any special technical knowledge.

Stripe has also grown to offer other services beyond payment processing, including fraud protection, tax collection, card issuing, financing, and more. It also offers some tools that are similar to what Plaid offers, such as Stripe Financial Connections.

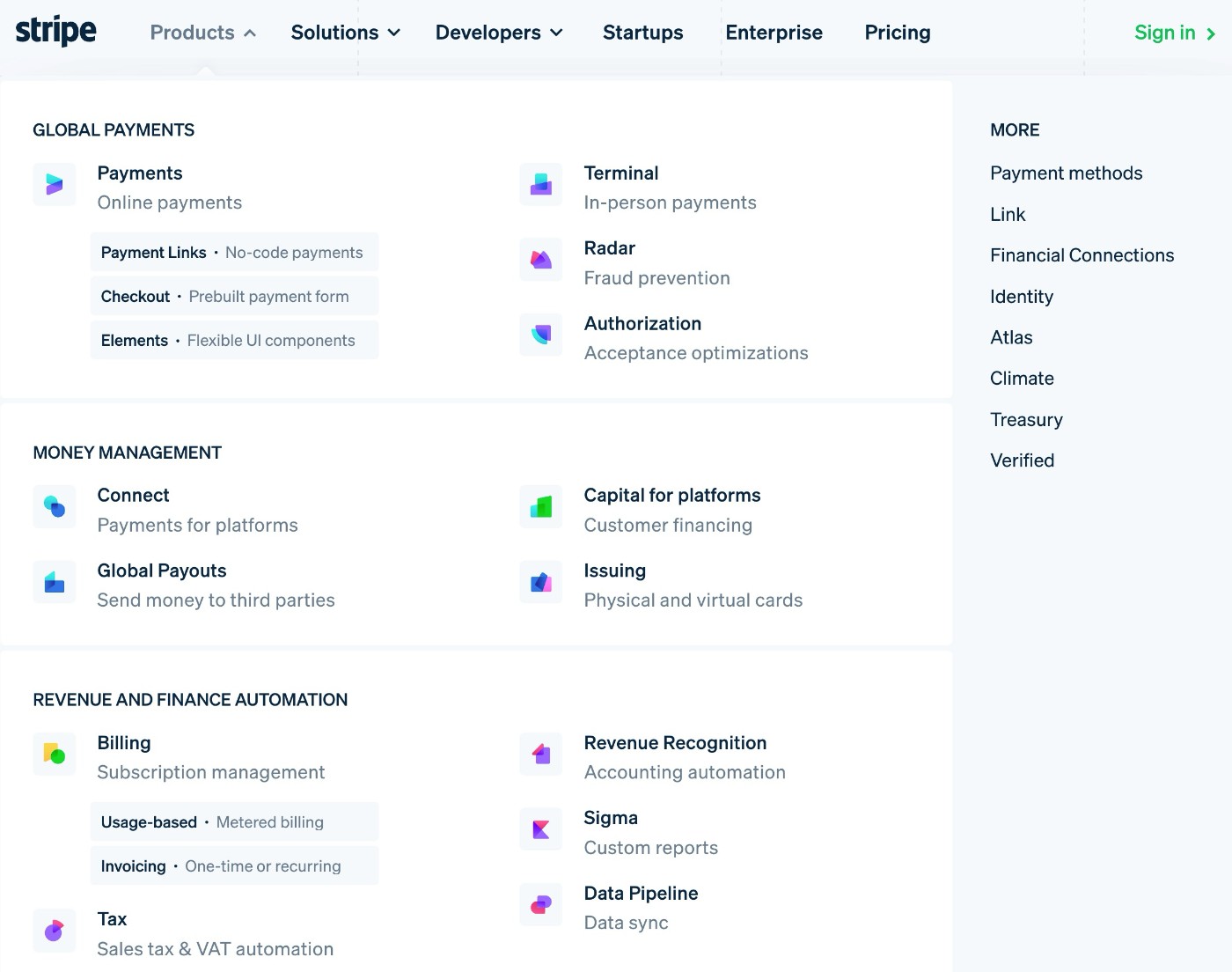

Stripe divides its product offerings into three high-level categories:

- Global payments

- Money management

- Revenue and finance automation

Supported payment methods

There are some pretty massive differences between the supported payment methods in Plaid and Stripe.

Plaid only works for bank-based payments. In the USA, it supports ACH, RTP, FedNow, and other methods. In Europe, it supports options such as SEPA Instant Credit Transfer, Faster Payments Service (FPS), and others.

However, Plaid notably does not offer payment processing for credit or debit cards, nor does it support other methods such as digital wallets like Apple Pay.

In contrast, Stripe offers significantly broader payment method support, with support for over 100+ different payment methods around the globe.

You can see all of Stripe’s supported payment methods here, but here’s a quick summary of some of the most popular options:

- Credit and debit cards – these include global and local networks such as Visa, Mastercard, American Express, Diners, Discover, JCB, and more.

- Digital wallets – these include Apple Pay, Google Pay, Cash App, PayPal (in Europe only), WeChat Pay, and others.

- Bank debits – these include ACH payments, Instant Bank payments via Stripe Link, SEPA Direct Debit, and others.

- Bank redirects – these include Bancontact, EPS, iDEAL, and others.

- Buy now, pay later – these include Affirm, Afterpay, Klarna, and others.

Essentially, unless you’re 100% certain that you will only want to accept bank-based payments, Stripe is going to be the better option.

Supported countries and currencies

In addition to offering broader payment method support, Stripe also offers much broader global support.

Currently, Plaid is available in 20 different countries, including the following:

- USA

- Canada

- UK

- Most, but not all, European Union countries (17 EU countries)

You can go to this page to check Plaid’s integrations with individual banks in those areas. In total, Plaid integrates with 10,000+ institutions in North America and around 2,000 institutions in Europe.

Stripe is currently available in 50+ different countries, including all of the countries where Plaid is available, plus many more. In addition to being available in 50+ countries, Stripe also lets you charge your customers in 135+ different local currencies.

You can go to these pages for more details:

When should you use Plaid or Stripe

Because Plaid and Stripe have slightly different feature sets and functions, we think it’s useful to summarize when you should consider using Plaid vs Stripe.

When to use Plaid

Plaid could be the better option if you need a way to securely connect to your customers’ bank accounts to read/verify balances, transactions, and other details.

While Stripe does offer some of this functionality with Stripe Financial Connections, Plaid is still the leader in the space.

You could also consider Plaid for payment processing, but only in very specific situations where you’re 100% certain that you’ll only need to send/receive money using bank transfers.

When to use Stripe

If your primary focus is on accepting payments, especially via cards or other payment methods, that’s when you should use Stripe.

As a payment processor, Stripe offers a significantly more robust feature set and much broader support for different payment methods. Plus, you can still use it to accept most bank-based methods, including ACH payments in the USA (though it doesn’t currently offer support for FedNow like Plaid does).

You can use both

Because Plaid and Stripe largely offer different services, though with some overlap, some businesses will end up using both services at the same time.

For example, a subscription-based budgeting app might use Plaid so that customers can securely connect their financial accounts for transaction tracking, while using Stripe to handle actual payment processing and subscription management.

Using Plaid and Stripe with WordPress

If you’ve built your website with WordPress and are looking to integrate payments into your site, you’ll typically do that with Stripe and not Plaid. Again, this is because Plaid is not a true payment processor like Stripe is.

If you want to use Stripe to accept payments via your WordPress site, you can create flexible payment forms using the Gravity Forms plugin and its Stripe Add-On.

The Gravity Forms Stripe Add-On lets you accept both one-time and recurring payments via many popular payment methods, including the following:

- Apple Pay

- Google Pay

- WeChat Pay

- ACH Direct (bank transfer payment in the USA)

- SEPA Direct Debit

- Bancontact

- EPS

- iDEAL

The exact payment methods that are available to your form will depend on your form’s currency and the location of your customers.

Here’s a summary of some of the most notable features in the add-on:

- One-time payments – Use any of the listed methods above to accept one-time payments.

- Subscription payments – Create your own custom schedules, such as charging customers monthly or yearly.

- Free trials and one-time setup fees – Offer a free trial period before the first payment and/or charge a one-time signup fee that only applies to the first billing cycle.

- Customer self-management for subscriptions – You can create a frontend area where your customers can manage their own subscriptions. You can place this dashboard anywhere on your site using a shortcode.

- WordPress dashboard payment management – Easily manage subscriptions and/or issue refunds directly from your backend WordPress dashboard.

- Authorize and capture – You have the option to authorize a customer’s card when they submit the payment form, but wait until a later time to capture the payment.

- Gravity Forms Stripe App integration – Install the official Gravity Forms Stripe app in your Stripe dashboard and then view form details in the Stripe interface.

To learn more about how everything works, you can read our complete guide to using Gravity Forms with Stripe.

Final thoughts

In the end, choosing between Stripe vs Plaid really just comes down to the specific needs of your business. In fact, because Stripe and Plaid largely perform different functions, it could be possible that you might want to use both Stripe and Plaid.

Stripe is the clear choice if you’re looking to accept payments via a variety of methods, including cards, digital wallets, bank transfers, “buy now, pay later” services, and more. You can easily integrate Stripe into your WordPress payment forms using the Gravity Forms plugin, accept in-person payments, or even build your own API connection if needed.

Plaid could be an option if you’re specifically looking to accept bank-based payments using ACH (or other methods like RTP or FedNow), but it doesn’t offer nearly as much flexibility for accepting other payment methods. Note – Stripe also allows you to accept ACH payments.

For WordPress users, there aren’t many pre-made Plaid WordPress integrations, so you might find it more difficult to integrate Plaid into your site.

If you want to start accepting payments using WordPress and Stripe, the Gravity Forms plugin and its Stripe Add-On can help you create both one-time and recurring payment forms.

To create your first WordPress payment form, purchase at least the Gravity Forms Pro license today.

If you want to keep up-to-date with what’s happening on the blog sign up for the Gravity Forms newsletter!