Stripe vs Adyen for online payments: How to choose

Debating between using Stripe vs Adyen to accept payments for your business?

Whether you’re accepting payments on your WordPress website or anywhere else, both Stripe and Adyen are flexible tools that can help you get the job done.

However, there are also some differences between the two that might push you in one direction or the other, especially if you’re a small business.

In this post, we’ll compare these two payment platforms in general, but also with a specific focus on helping WordPress-based businesses accept payments. We’ll focus on these areas:

- General introductions

- Notable payment processing functionality

- Processing rates and other notable pricing/fees

- Supported payment methods

- Supported countries and currencies

- Gravity Forms/WordPress integrations

- In-person payments

If you’re already using the Gravity Forms plugin to create WordPress payment forms, we’ll help you make sure you’re using the right payment processor.

And if you haven’t set up your first WordPress payment form yet but you’re interested in getting started, this guide will help you make the right choice from day one.

Let’s get into everything that everyone, and especially WordPress users, need to know about Stripe vs Adyen…

Quick introductions to Stripe and Adyen

Before we compare Stripe vs Adyen in more detail, let’s start with some basic introductions to these two tools, such as their core offerings and the types of businesses that they work with.

Stripe introduction

Stripe is a fintech (financial technology) platform launched back in 2010.

It’s probably best known for its payment processing, which makes it easy for businesses of all sizes to process both online and in-person payments.

In 2024, Stripe’s total payment volume was a whopping $1.4 trillion.

In addition to payment processing, Stripe also offers a number of other financial infrastructure products, including tools for fraud protection and authorization, subscription management, banking, taxes, and more.

Stripe has always focused on being developer-friendly, with APIs for all of its services that let developers easily integrate Stripe into any platform.

If you’re not a developer, you can take advantage of pre-made solutions. For example, if you’re using WordPress for your website, you can use the Gravity Forms plugin and its Stripe Add-On to easily create payment forms without ever needing to interact directly with the API.

Stripe also works with businesses of all sizes, including small businesses and solopreneurs. There are no monthly minimums or monthly fees to use Stripe – anyone can sign up for an account and access Stripe’s payment processing functionality. This is a notable difference between Stripe and Adyen.

Adyen introduction

Founded in 2006, Adyen is also a fintech platform that offers payment processing and other associated products/services, such as fraud management, authentication, and optimization.

It was launched in the Netherlands but expanded globally around 2012 and now helps businesses all around the world accept online and in-person payments.

Like Stripe, it processes an astounding volume of global payments. In 2024, Adyen hit $1.3 trillion in total payment volume – just a measly $100 billion behind Stripe.

While technically anyone can use Adyen, Adyen is more focused on larger, enterprise use cases.

For example, Adyen requires minimum processing volumes in some industries, which might make it unsuitable for small businesses that are unlikely to meet those minimum volumes.

While Adyen doesn’t publicly share these monthly minimums and there are variables that can affect the specific numbers, some people on Reddit report numbers such as 5,000 transactions per month or millions in payment value.

Notable payment processing functionality

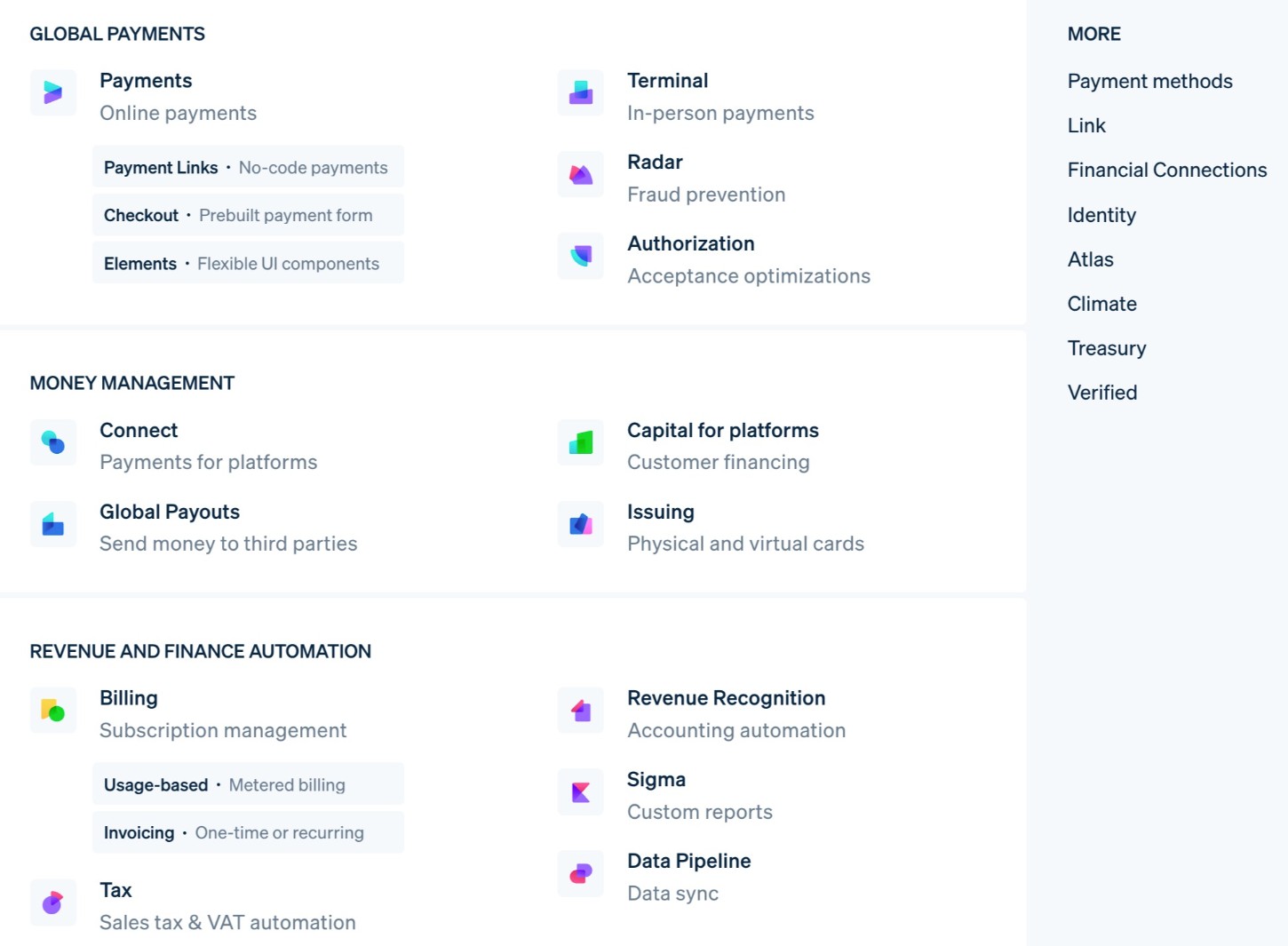

Now, we’ll go into a more in-depth comparison of the most notable features that Stripe and Adyen offer. For this guide, we’ll focus primarily on payment processing, but both Stripe and Adyen also offer other financial products and services.

Stripe notable features

- Online and in-person payments – You can use Stripe to process payments both online and in-person.

- Support for a variety of payment methods – Stripe can handle a lot more than just credit and debit card payments, with support for over 100 different global payment methods.

- Subscription payments – Stripe offers robust tools for recurring payments, including flexible billing periods, subscription management, and more.

- Reporting tools – You get lots of tools to analyze your business’s payments and revenue.

- Fraud protection tools – In addition to built-in protections, you can also use Stripe Radar to create your own custom fraud rules.

- Gravity Forms Stripe Add-On – If your website is built with WordPress, you can easily create Stripe payment forms using the Gravity Forms Stripe Add-On.

- Tax compliance – Stripe Tax can help you collect accurate global taxes, including sales tax and VAT.

Adyen notable features

- Online and in-person payments – Adyen works for both online and in-person payments.

- Support for a variety of payment methods – Adyen supports more than 100 different global payment methods.

- Subscription payments – Adyen also offers strong support for recurring payments, including tools to recover failed subscription payments.

- Reporting tools – Adyen offers detailed reporting tools, including reports to help you increase authorization rates and optimize payment methods.

- Fraud protection tools – Adyen lets you create your own fraud protection rules in addition to benefiting from the platform’s built-in protections.

Pricing, rates, and notable fees

Comparing payment processing rates between Stripe vs Adyen is a bit tricky because they use different models to determine their rates:

- Stripe – fixed rate – Stripe charges the same fixed rate for all similar card payments. You’ll pay the same rate for Visa Rewards Traditional, Visa Rewards Signature, MasterCard, American Express, etc.

- Adyen – variable “Interchange plus” rates – Adyen charges a variable processing fee based on the interchange fee plus a fixed markup. Interchange fees can vary based on the type of card, brand, region, and more, which means there’s no one single fixed processing rate that you’ll pay.

Because of these differences, both Stripe and Adyen can have lower processing rates in different situations.

We’ll explain these differences in more detail below, along with some other notable fees.

Stripe

Stripe charges the following rates for payments in the USA:

- Online card payments – 2.9% + $0.30 per transaction

- Online wallet payments (Apple Pay, Google Pay, etc.) – 2.9% + $0.30 per transaction

- In-person card payments – 2.7% + $0.05 per transaction

- Manual card entry card payments – 3.4% + $0.30 per transaction

- ACH payments – 0.8% ($5 cap)

- Stripe Link payments – 2.9% + $0.30 for domestic cards or 2.6% + $0.30 for Instant Bank Payments

This page has more details on Stripe’s USA pricing, and here are Stripe’s pricing pages for some other regions:

Because Stripe uses fixed processing fees for each type of payment, you’ll know exactly what processing rates you’ll pay for each transaction.

Stripe chargeback fees

Stripe charges a non-refundable $15 fee for disputed payments, regardless of the outcome.

Stripe monthly account fees and minimums

Stripe does not have any fixed monthly fees or minimum processing amounts for its payment processing services.

This can make it especially ideal for small businesses that might struggle to meet Adyen’s minimums.

Adyen

At the time of this post, Adyen charges “Interchange Fee + 0.60% + $0.13 per transaction” for Visa and Mastercard card payments, with the 0.60% being a fixed markup from Adyen.

Because there are variables that can affect the interchange fee, this means Adyen has no singular processing rate that applies to every card transaction.

On average, interchange fees are around 2% in the USA and 0.3%-0.4% in Europe, according to Adyen. However, interchange rates can vary from as low as 1.5% to as high as ~2.8%, based on variables such as the type of transaction, the card brand, the region, the industry, etc.

There can even be differences within a single card brand – for example, Visa Rewards Traditional branded cards have a lower interchange fee than Visa Rewards Signature cards, which themselves have a lower rate than Visa Rewards Signature Preferred cards.

Here are some estimates of what you might pay with both the interchange fee and fixed markup, but it’s important to note again that these are not fixed rates:

- Online card payments (Visa + Mastercard) – Estimated to be around ~2.50%-3.20% + $0.13 per transaction (could be slightly higher or lower)

- Online wallet payments (Apple Pay, Google Pay, etc.) – Depends on card used, but generally the same as online card payment rates

- In-person card payments – Estimated to be around ~2.20%-2.80% + $0.13 per transaction (could be slightly higher or lower)

- Manual card entry card payments – Estimated to be around ~2.50%-3.20% + $0.13 per transaction (could be slightly higher or lower)

- ACH payments – $0.40 per transaction

All in all, Adyen’s rates can be both lower and higher than Stripe – it depends entirely on the interchange rate that’s applied to each transaction.

To see Adyen’s rates for other countries and payment methods, you can go to the Adyen pricing page. It lets you search for specific payment methods and filter by country.

Adyen chargeback fees

Adyen charges a $10 chargeback fee for payments in the USA, regardless of the outcome of the dispute.

Adyen monthly account fees and minimums

While Adyen doesn’t charge a monthly account fee, it does require a minimum monthly processing volume for some industries, which could be a minimum number of transactions or a minimum payment volume.

This could make it inaccessible to small businesses that aren’t able to meet Adyen’s minimums, and is one of the biggest reasons why many WordPress webmasters might prefer Stripe.

Supported payment methods: Stripe and Adyen

In addition to letting you accept credit and debit card payments, both Stripe and Adyen support a wide variety of additional payment methods, including digital wallets, bank transfers or debits, buy now, pay later, and more.

Both services support well over 100 different methods, including all of the most popular options. The exact methods that are available to you will depend on geographic location, currency, and your implementation method (such as whether you’re using Gravity Forms to create WordPress payment forms).

Here’s a summary of some of the services that both Stripe and Adyen support, though this is by no means a complete list:

- Global and local digital wallets – These include Apple Pay, Google Pay, WeChat Pay, Cash App Pay, GrabPay, Alipay, and many others.

- Bank transfer and debit payments – You get many options for bank-based payments, including ACH payments in the USA, SEPA transfers in Europe, EPS, Bancontact, SPEI (Mexico), and many others.

- Buy now, pay later methods – These include Affirm, Afterpay, Klarna, and many others.

You can use the links below to find the full list of payment methods that both services support:

Supported countries and currencies

Both Stripe and Adyen offer broad global support, with both services supporting many different countries around the world and well over 100 different currencies.

Stripe

Stripe currently offers the following global support:

- Available in 50+ countries

- Supports charging your customers in 135+ different local currencies

- Offers cross-border payouts in 114+ different countries

Charging customers in their local currencies can offer better conversion and authorization rates, while also offering a better customer experience. You can then choose to receive the money in your own local currency.

You can go to these pages for more details:

Adyen

Adyen also offers broad global support for many countries and currencies:

- Available in almost 100 different countries

- Supports charging your customers in 150+ different local currencies

- Offers local currency payout support for 40+ currencies

For more information, you can consult these links:

Gravity Forms add-ons

If you want to accept payments on your WordPress website, you can use the Gravity Forms plugin to create simple or complex payment forms.

Below, we’ll cover how you can integrate Gravity Forms and WordPress with Stripe and Adyen.

In addition to the specific features that we cover below, it’s also important to note that you can integrate payments with other add-ons and core features in Gravity Forms, such as charging users to register for an account on your site or syncing customer data with your CRM after they make a payment.

Stripe Add-On

The Gravity Forms Stripe Add-On is available on the Pro, Elite, and Nonprofit licenses.

With the add-on, you can accept both one-time and recurring payments via a variety of different payment methods, including the following:

- Apple Pay

- Google Pay

- WeChat Pay

- ACH Direct (bank transfer payment in the USA)

- SEPA Direct Debit

- Bancontact

- EPS

- iDEAL

The specific payment methods that you can enable will depend on the currency of your form and the geographic locations of your customers.

Beyond support for multiple payment methods, here are some of the other notable features in the Gravity Forms Stripe Add-On:

- One-time payments – Accept one-time payments using any of the payment methods mentioned above.

- Subscription payments – You can fully customize the billing schedule, such as charging customers monthly or yearly.

- Free trials and one-time setup fees – Specify a free trial period before charging customers and/or add one-time signup fees to the first payment.

- Customer self-management for subscriptions – Use a shortcode to add a frontend area on your site where customers can manage their own subscriptions.

- WordPress dashboard payment management – You and other admins can also manage subscriptions and process refunds directly from the WordPress dashboard.

- Authorize and capture – Choose to authorize a customer’s card when they submit your payment form, but not process the actual payment until a later time.

Gravity Forms also offers its own official Stripe app. You can install this in your Stripe dashboard and then view form details in the Stripe interface.

If you want to learn more, check out our ultimate guide to using Gravity Forms with Stripe.

Gravity Forms Adyen integration

Gravity Forms does not currently offer an official add-on for Adyen. If you think an official Adyen add-on would be helpful, you can share your feedback on the Gravity Forms product roadmap board.

There are also some add-ons from third-party developers that can integrate Gravity Forms with Adyen. These add-ons have not been certified by the Gravity Forms team, though, so we recommend performing due diligence before installing one on your site.

In-person payments (physical hardware)

While both Stripe and Adyen are probably best known for online payments, they also both support in-person payments, either via their own hardware or hardware from providers such as Verifone.

With that being said, you might alternatively want to consider Square if having robust in-person payment solutions is important to your business. To learn more, we have a post comparing Stripe vs Square. You can also use the Gravity Forms Square Add-On to accept WordPress payments using Square.

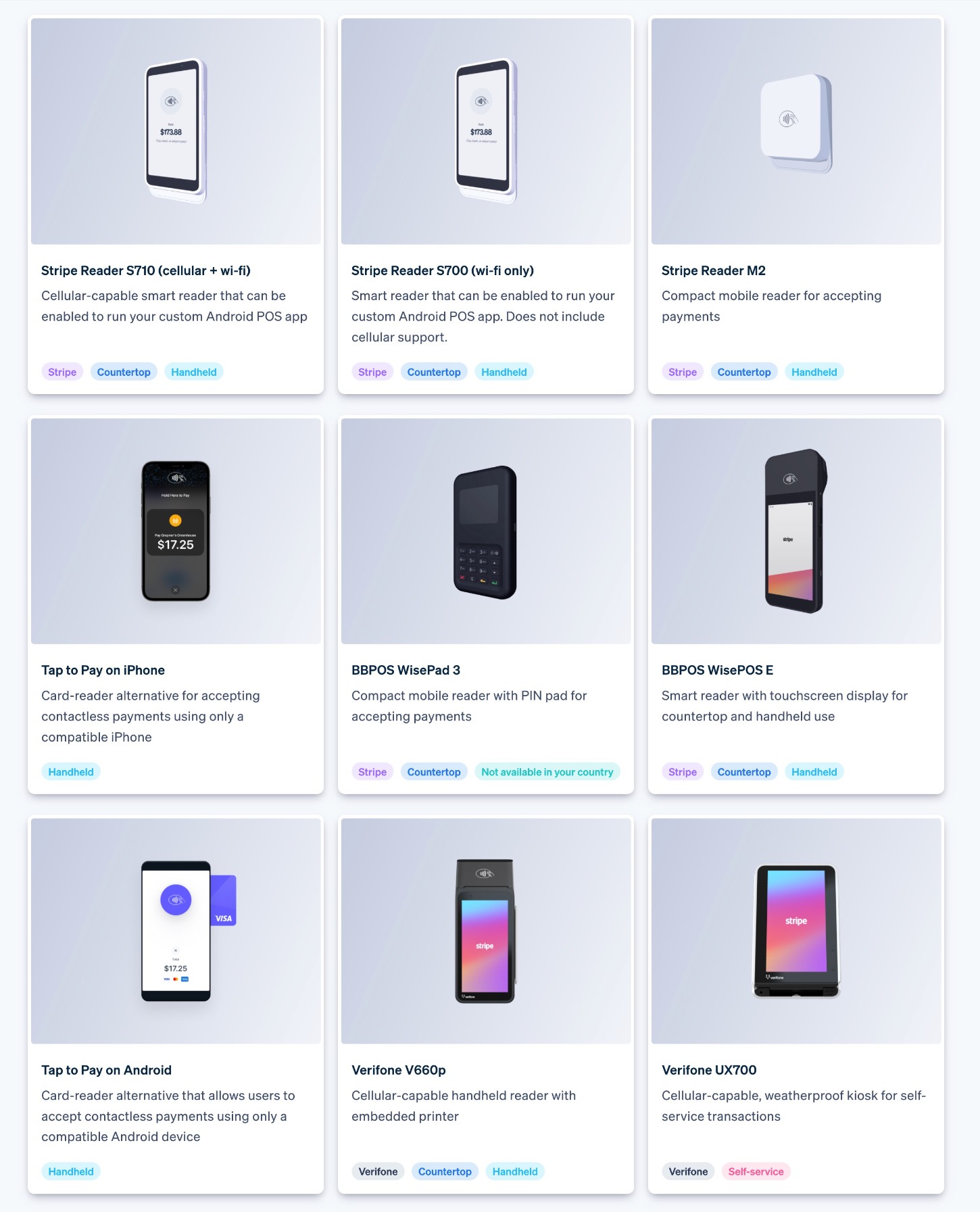

Stripe

Stripe offers its own physical hardware for in-person payments, along with integrations with devices from other popular providers such as Verifone, BBPOS, and others.

In terms of Stripe’s own physical hardware, Stripe currently has two offerings:

- Stripe Reader M2 – A very small mobile reader that you can integrate with other devices, such as your POS.

- Stripe Reader S700 – An Android-based reader with its own screen that you can use as a countertop or handheld solution.

In addition to this hardware, Stripe also offers its own mobile apps for iOS and Android that let you accept contactless payment methods via your existing mobile device.

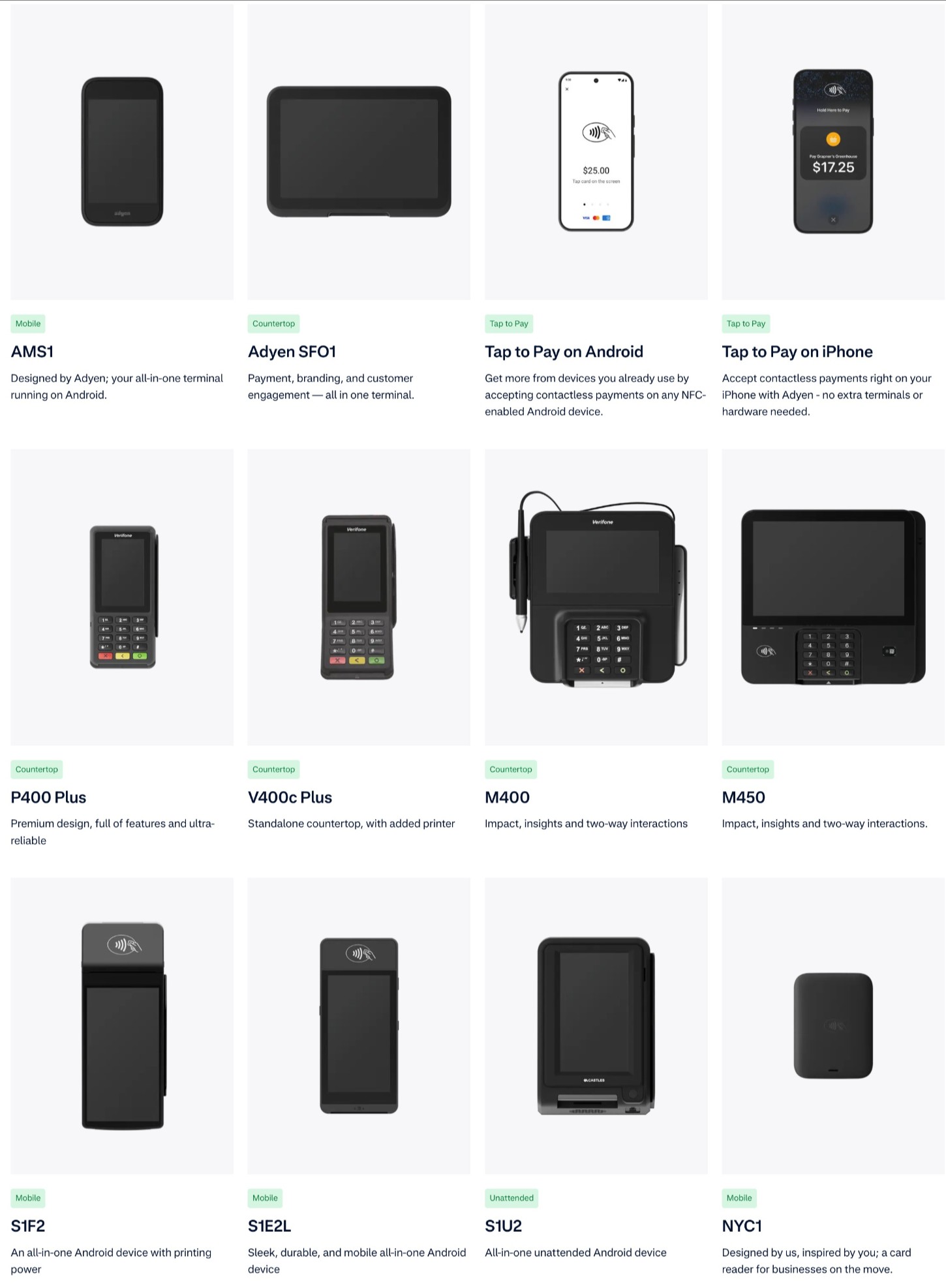

Adyen

Adyen supports in-person payments via its own physical hardware, as well as integrations with other well-known providers such as Verifone and Castles Technology.

In terms of its own hardware, Adyen also currently offers two options:

- AMS1 – A mobile terminal that’s powered by Android.

- Adyen SFO1 – A countertop terminal device that includes more of a tablet-like experience.

Adyen also offers mobile apps for iOS and Android that support tap-to-pay contactless payments on your existing mobile device.

Start accepting payments today

Stripe and Adyen are both well-established payment processing solutions with broad support for different payment methods, countries, and currencies. As such, you won’t really go wrong using either platform. Instead, it’s really about choosing the best option for your specific situation.

For most small businesses, especially those that are using WordPress, Stripe probably makes the better choice.

It has no monthly minimums or fees, which means you can use it regardless of the size of your business. It also has clear fixed pricing that makes it easy to know exactly how much you’ll pay to process each transaction.

Most importantly, it’s also super easy to integrate into your WordPress site, especially if you use the Gravity Forms plugin and Gravity Forms’s dedicated Stripe Add-On.

Adyen does have some advantages, such as an “interchange plus” model that can offer lower processing fees on some transactions, along with even broader global support than Stripe. However, it’s not as easy to use as Stripe, and it’s generally geared toward larger businesses. This means that it might not even be an option for most WordPress sites.

If you want to start accepting WordPress payments using Gravity Forms and Stripe, you can purchase the Gravity Forms Pro, Elite, or Nonprofit license and then follow our guide to WordPress payments to get started.

If you want to keep up-to-date with what’s happening on the blog sign up for the Gravity Forms newsletter!