Mollie vs Square: Full comparison for WordPress sites and more

Trying to choose between Mollie vs Square as the payment processing solution for your business and/or WordPress website?

Both Mollie and Square can help you accept online and in-person payments, but there are also some pretty big differences between the two that might push you in one direction or another.

In this post, we’re going to compare Square and Mollie so that you can pick the right payment solution for your business.

We are not going to pick a single “winner”. Instead, we’ll just highlight the similarities and differences so that you can make the optimal decision for your unique situation.

To do this, we’ll cover the following areas:

- Notable features and what you can do with each tool

- Supported countries and currencies

- Pricing and payment processing rates

- Gravity Forms add-ons, in case you want to use either service to accept WordPress payments

Square promotion – free processing

Gravity Forms and Square have teamed up to offer an exclusive promotion for new Square customers — enjoy free processing fees for up to 180 days!

Here’s how it works:

- Free Payment Processing – Get $3,000 in credit card transactions processed for free within your first 180 days. After that, standard Square fees apply.

- $20 Off Square Hardware – Receive a $20 discount on Square hardware once you sign up.

To take advantage of this promotion, simply sign up for a Square account using this link and start processing payments with no extra fees.

Quick introductions to Square and Mollie

Before getting into our more detailed comparison, we think it’s useful to start with some quick introductions to set the stage for some fundamental differences between Mollie vs Square.

Mollie

Mollie is a payment processing service designed to help European businesses accept online or in-person payments via cards, as well as a variety of local European payment methods, including iDEAL, Bancontact, Sofort, and more.

That European focus is one of the most notable differences between Mollie and Square. At this time, Mollie only supports businesses from within the European Economic Area (EEA), Switzerland, and the United Kingdom.

Square

Square also offers broad support for online and in-person payments like Mollie. However, Square also goes beyond just payments.

With the addition of software tools to help organizations run and manage their businesses, Square offers dedicated tools for restaurants, retail shops, and appointment-based businesses.

Square accepts more global businesses, with support for the USA, Canada, Australia, and Japan, in addition to some European countries (though Square’s European coverage is not as broad as Mollie).

What can you do with Mollie and Square?

With those introductions out of the way, let’s talk about what Mollie and Square can help you do in more detail, including some of the most notable features in each.

Mollie

Mollie is primarily a payment processing service. It lets you easily accept both online payments and in-person payments.

If you want to accept online payments, there are two main routes that you can take:

- Integrate Mollie into your website – If you already have a website, you can integrate Mollie into pretty much any platform. On WordPress, the Gravity Forms plugin and its Mollie Add-On make it easy to create simple or complex payment forms that process payments via Mollie.

- Use Mollie’s tools – Mollie also offers its own invoicing tools, as well as payment links that you can use for an even simpler option.

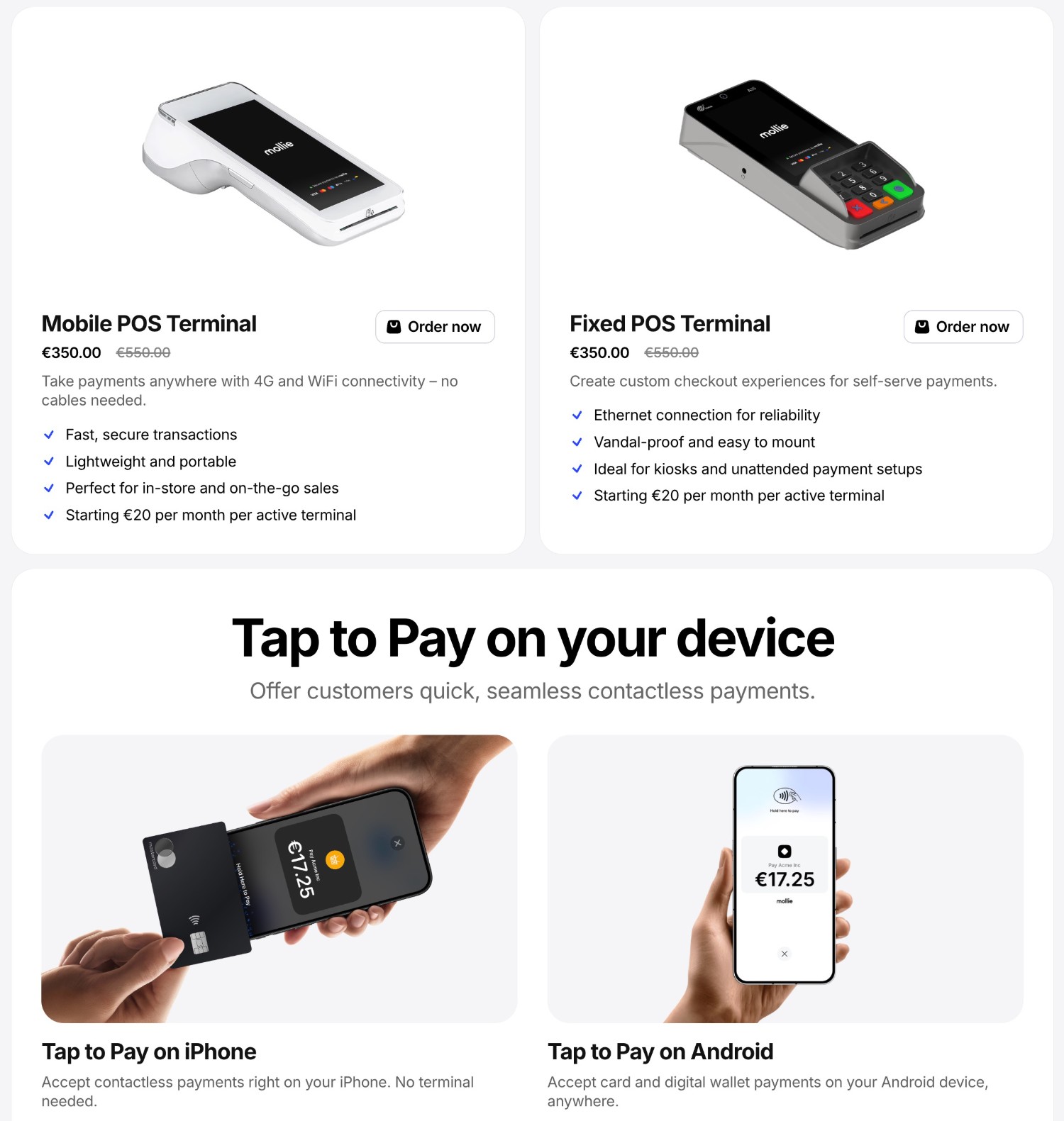

If you want to accept in-person payments, Mollie also offers its own physical hardware that lets you process card payments or some other methods, such as digital wallets like Apple Pay.

Mollie does not offer full point of sale (POS) system hardware like Square does. Instead, you just get a small terminal that handles the actual payments, with fixed and mobile options. You can then integrate this payment terminal into the POS system you are using.

You can also accept contactless payments directly on your own smartphone thanks to IOS and Android apps.

Square

In general, Square can do “more” than Mollie, though this may or may not matter for your business’s specific situation.

To start, Square offers payment processing for both online and in-person payments, just like Mollie.

For online payments, you have the same two high-level options:

- Integrate Square into your website – For example, if you have a WordPress website, you can use Gravity Forms and its Square Add-On to create all kinds of payment forms that process one-time or subscription payments via Square.

- Use Square’s tools – Square offers robust invoicing software, as well as simple payment links that you can share with anyone. Square also offers its own online store and website builder.

Square also offers physical hardware to help you accept in-person payments, with a more robust set of solutions than what Mollie offers.

For example, in addition to letting you use your smartphone or small payment terminals, Square also offers full POS systems and self-service kiosks, along with associated hardware such as kitchen display system (KDS) for restaurants.

There’s also a large ecosystem of third-party hardware that integrates well with Square, which gives you a lot of flexibility.

Finally, one of the large differences between Square vs Mollie is that Square also offers software solutions to help you run your business. This is something that Mollie does not currently offer.

Here are some of the most notable tools that Square offers for businesses, though this is not the complete list:

- POS system – You can use Square’s POS system to run your business. Square has tools for restaurants, retail stores, appointment-based businesses, and more. For restaurants, you can also integrate your POS with a kitchen display system to manage your kitchen.

- Inventory management – For retail businesses, Square can help you manage your inventory, including syncing stock status between your online store and retail shop.

- Appointment booking/management – You can use Square Appointments to manage any type of appointment-based business, such as salons, spas, coaching, equipment rentals, etc.

- Marketing/customer loyalty tools – You can access lots of marketing tools for your business, including a customer relationship manager (CRM), email marketing, physical or digital gift cards, loyalty programs, and more.

- Payroll and shift management – If your business has employees, Square can help you manage them with tools like Square Payroll (payroll management) and Square Shifts (employee scheduling).

Here are links to browse all of Square’s software and supported business types.

If you think that these tools could help your business be more successful, that might be a reason to consider Square over Mollie.

Supported countries and currencies

As we mentioned earlier, Square and Mollie have some pretty big differences in their supported geographic areas.

In this section, we’ll compare the global country and currency support of Square vs Mollie.

Mollie

Currently, Mollie focuses its services exclusively in Europe. Mollie supports all countries in the European Economic Area (EEA), Switzerland, and the United Kingdom.

Mollie also supports many payment options, including American Express, MasterCard, Maestro, and Visa as well as as well as a number of other European payment methods, including iDEAL, Bancontact, Sofort, and more, to give your visitors a good range of choices.

However, Mollie notably does not accept businesses in the USA, Canada, Australia, and anywhere else outside of Europe. You can accept payments from customers in the USA and other non-European countries, but your company must be based in one of the supported countries.

Here’s the full list of countries that Mollie supports:

- Austria

- Belgium

- Bulgaria*

- Croatia*

- Cyprus*

- Czech Republic

- Denmark

- Estonia*

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland*

- Ireland

- Italy

- Latvia*

- Liechtenstein*

- Lithuania*

- Luxembourg

- Malta*

- The Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovenia

- Slovakia*

- Spain

- Sweden

- Switzerland

- United Kingdom

For countries marked with an asterisk, you’ll need to meet a certain minimum sales volume to be eligible to use Mollie. For countries without an asterisk, there are no minimums.

Mollie also supports 11 currencies for multi-currency payouts, which lets you accept payments and receive payouts in the same currency. In addition to the Euro, some notable currencies here are United States Dollars (USD), British Pounds, Canadian Dollars, and Australian Dollars.

Square

Whereas Mollie focuses exclusively on Europe, Square offers its services to businesses on multiple continents.

Currently, Square supports businesses in the following countries and local currencies:

- USA

- Canada

- UK

- Australia

- Japan

- Ireland

- France

- Spain

If you’re in the USA, this makes Square the clear option. The same holds true for Canada, Australia, and Japan. The only overlap between the two is in the UK, Ireland, France, and Spain.

While Square only accepts businesses from the countries above, Square does let you accept payments in pretty much any currency and will work with all US-issued and most internationally-issued cards.

Square will process payments in the currency of the country where your business is located. For example, if you’re in the USA but your customer is in Germany, Square will process the payment in USD.

Square does not charge its own currency conversion fee or markup. The exchange rate that the customer experiences will be determined by the customer’s card issuer.

Pricing, rates, and notable fees

Next, let’s look at the prices and payment processing rates that you’ll pay at Mollie vs Square. The following is correct at the time of this writing.

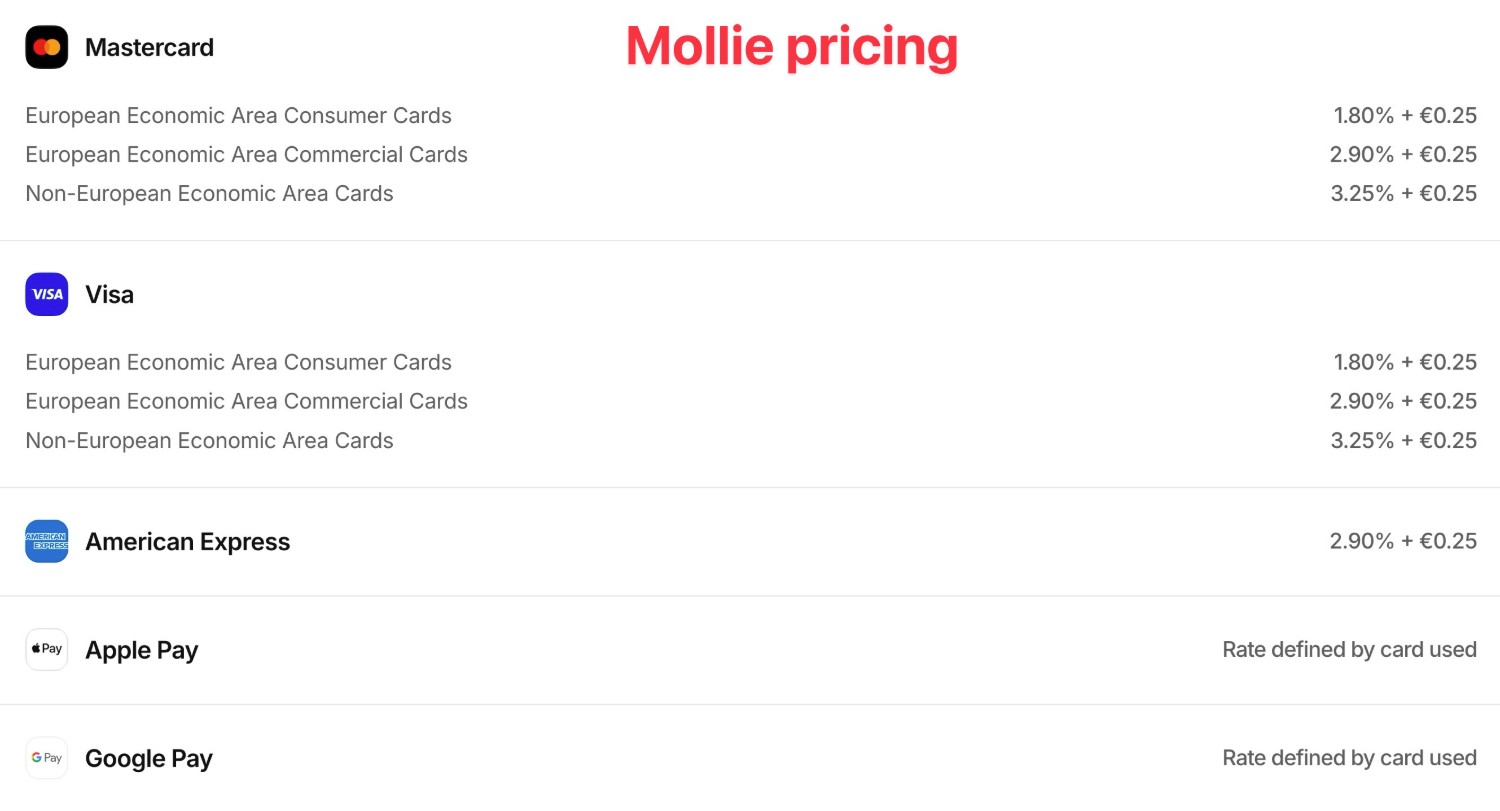

Card processing rates

In addition to whatever fixed costs you pay for hardware and/or software (more on that below), you’ll also need to pay a processing fee for each payment that you accept.

The exact rate that you pay will depend on the type of card you’re processing, the type of payment (e.g. in-person vs online), and other variables.

For that reason, we can’t give you one single “processing rate” to compare.

However, we can compare some of the most popular types of payments to give you an idea of Mollie vs Square processing fees.

Mollie

- Non-European Economic Area (EEA) cards – 3.25% + €0.25

- EEA consumer cards – 1.80% + €0.25

- EEA commercial cards – 2.90% + €0.25

- American Express – 2.90% + €0.25

- Consumer debit/credit cards – 1.80% + €0.10

- Business debit/credit cards – 2.90% + €0.10

- Maestro/VPay debit cards – 0.20% + €0.06

Note – If you want to accept a non-Euro currency, there might be additional currency exchange fees as part of the processing fee, though this doesn’t apply to all currencies.

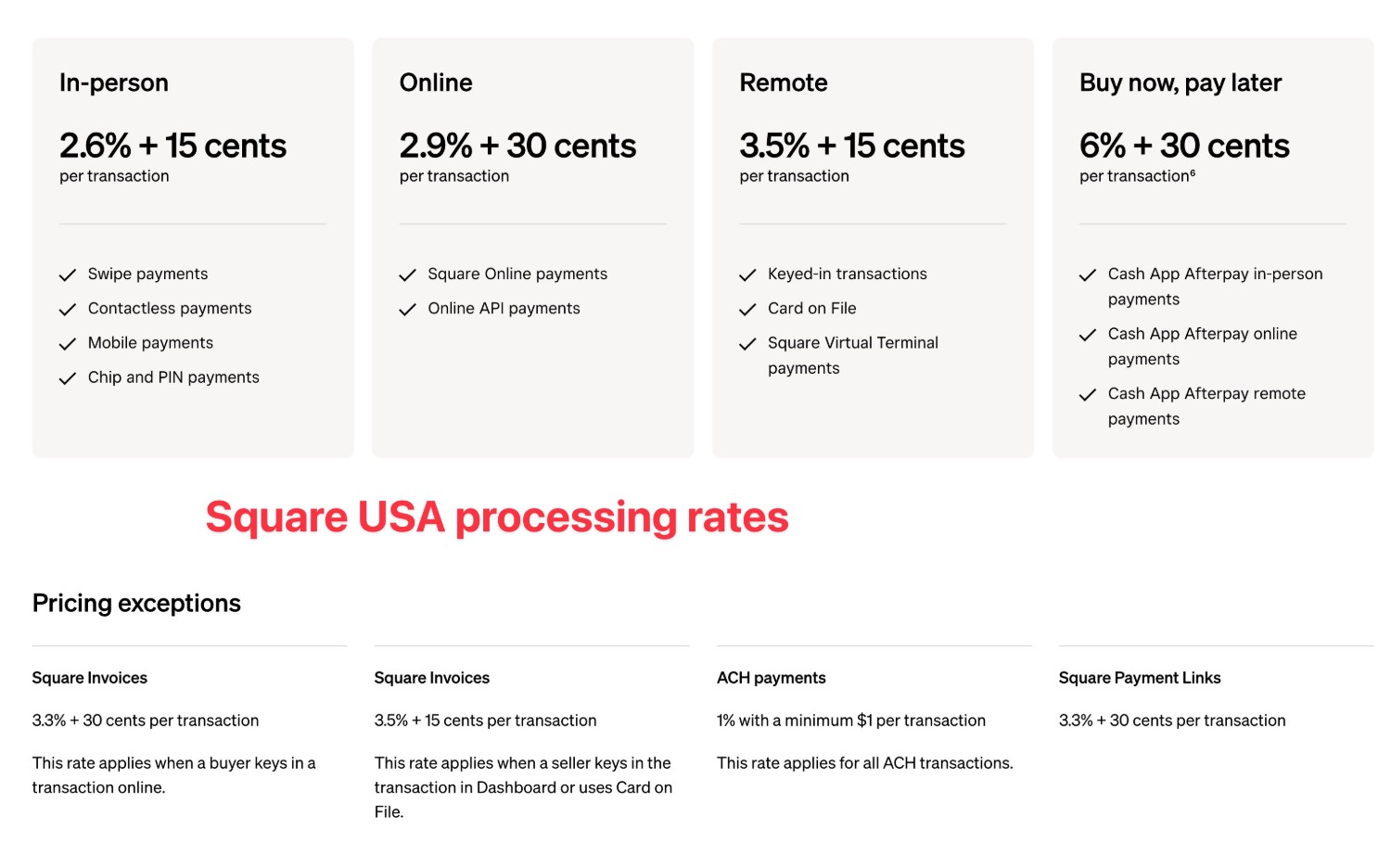

Square

With Square, the card processing rates can vary greatly based on the location/currency of your business, along with the type of payment.

We’ll share the rates for both USA payments and one country within the EEA (we’ll choose France). We’re choosing France because it gives you more of a 1:1 comparison with Mollie’s rates, as Mollie does not currently accept USA-based businesses.

- Online card payments – 2.9% + $0.30 per transaction

- In-person card payments – 2.6% + $0.15 per transaction

- Manual card entry card payments (e.g. you manually keying in a person’s credit card) – 3.5% + $0.15

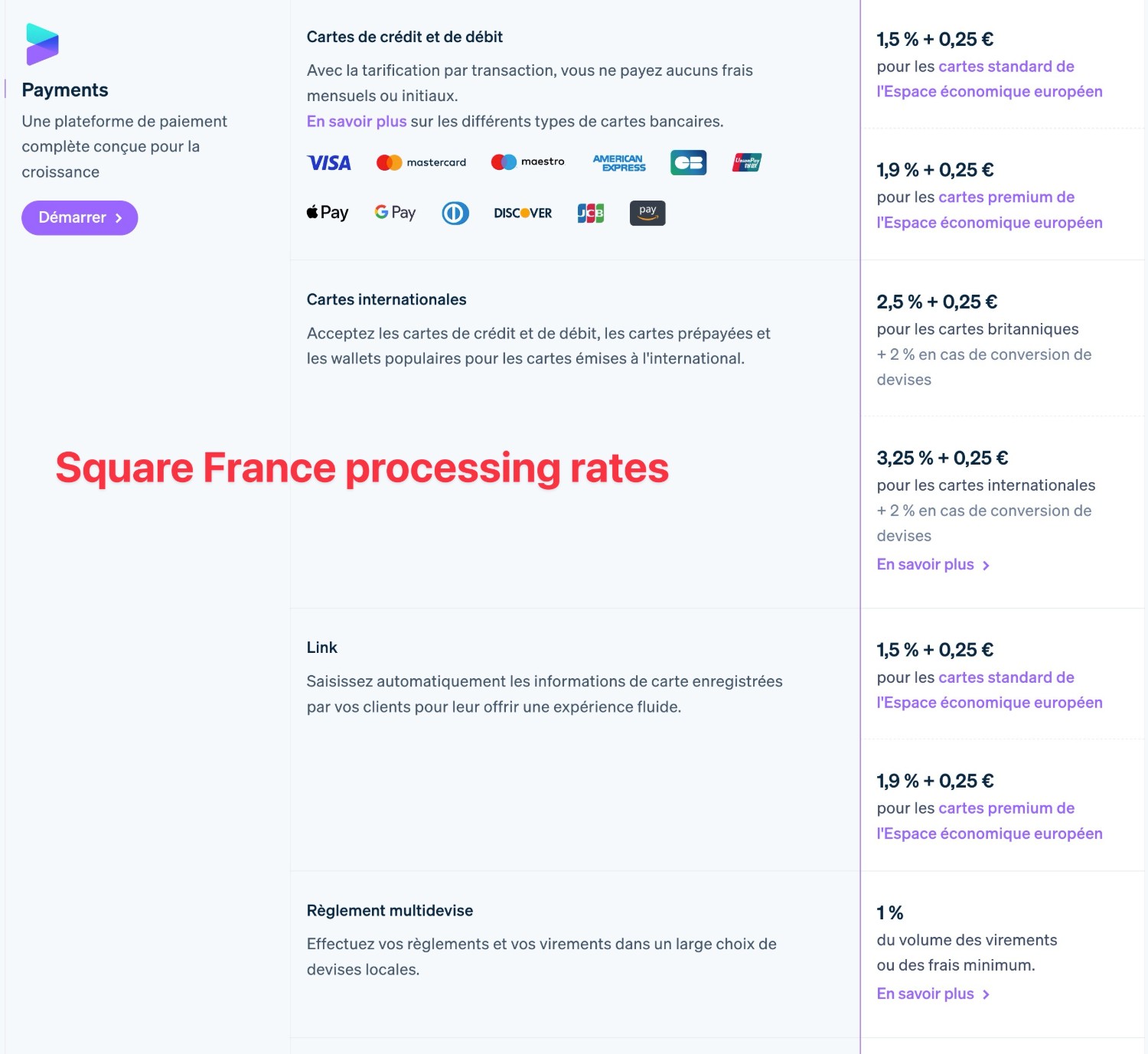

Square card payments (France):

- EEA consumer cards – 1.50% + €0.25

- EEA commercial cards – 1.90% + €0.25

- British cards – 2.50% + €0.25

- International cards – 3.25% + €0.25

As you can see, Square’s variable fee for EEA cards is 0.3%-0.4% lower than Mollie, which could add up over time.

Here are Square’s processing rates for some other locations:

Hardware and/or software fees

If you just want to accept online payments, neither Square nor Mollie charges any additional fees beyond the processing rates (and other potential processing-related fees, such as credit card chargebacks).

You can sign up for a free account at Square or Mollie. Then, you could use each service’s API to integrate payments into your website or use their payment link/invoicing tools. For example, if you have a WordPress website, you could use the Gravity Forms plugin to accept payments with both Square and Mollie (more on that below).

However, if you want to access physical hardware to accept in-person payments, you might need to pay for that hardware.

Square also offers monthly plans for some of its small business/software tools, such as the point of sale (POS) system, inventory management, appointment management, employee scheduling, payroll, etc.

Mollie

Mollie currently charges a one-time €350 fee to purchase either of its payment terminals. However, you also need to pay an additional €20 per month for each active terminal that your business is using (even if you don’t process any payments in a given month).

This monthly fee is notable because Square does not charge a monthly fee just to use a terminal.

Square

If you just want to use Square’s hardware for in-person payments but you don’t need any of the software tools, you can purchase the hardware for a one-time fee:

- Square Reader for magstripe – Free

- Square Reader for chip and contactless payments – $59

- Square Handheld – $399

- Square Stand – $149 (you’ll also need your own iPad)

- Square Kiosk – $149 (you’ll also need your own iPad)

- Square Terminal – $299

- Square Register – $799

Unlike Mollie, Square does not charge any monthly fee for each active terminal. You only pay the processing rates when you accept a payment.

In addition to selling the hardware directly, Square also offers subscription plans that include both the hardware and the software tools that we mentioned earlier. The price of these plans will depend on what type of business you’re running.

- Restaurants – Free plan to start. Paid plans from $69/month/location.

- Retail – Free plan to start. Paid plans from $89/month/location.

- Appointments – Free plan to start. Paid plans from $29/month/location.

Gravity Forms Add-Ons: Square vs Mollie

If you want to accept payments on your WordPress website, Gravity Forms offers its own official add-ons for both Square and Mollie that let you add payment processing to any form that you create with Gravity Forms.

You can create one fixed price that applies to everyone who uses the form. Or, you can adjust the price based on how a person fills out the form, which can work great for lightweight ecommerce stores or customized services.

You can also integrate payments into other forms on your site. For example, you could charge people to create an account on your site by integrating payments into a custom user registration form.

Or, you could charge people to submit content to your site. For example, you could create a job board website and then charge companies to submit job listings.

Here are some more details on both add-ons and using Gravity Forms for Square or Mollie WordPress payments…

Gravity Forms Mollie Add-On

The Gravity Forms Mollie Add-On lets you integrate Mollie payments into any form on your site.

With it, you can accept one-time card payments via any form on your site. To learn more and see it in action, check out our guide to WordPress Mollie payments.

Gravity Forms Square Add-On

The Gravity Forms Square Add-On has the same basic functionality as the Mollie Add-On, but it gives you a little bit more flexibility for setting up your payment forms.

For example, you can use the Square Add-On to set up recurring subscriptions, whereas the Mollie Add-On currently only supports one-time payments.

It also supports other useful features, such as authorize and capture and the ability to manage subscriptions and refund payments right from your WordPress dashboard.

To learn more, check out our ultimate guide to WordPress and Square. We also have a tutorial on accepting WordPress subscription payments with Square.

Start accepting payments today

Square and Mollie are both quality solutions for accepting in-person and online payments. In the end, choosing between them really comes down to your own unique situation.

Mollie is exclusively focused on helping European businesses accept payments, including via local European payment methods. In contrast, Square has a more global presence that includes support for the USA, Canada, and Australia, as well as Japan and some European countries (though not as many as Mollie).

Square also goes a bit further than Mollie in what it offers, with the addition of more robust hardware tools and software tools to help restaurants, appointment-based businesses, and retail shops manage their businesses.

Regardless of how you pick between Square vs Mollie, you’ll be able to integrate both services with your WordPress site thanks to Gravity Forms and its Square Add-On and Mollie Add-On.

You can access both add-ons on the Gravity Forms Pro, Elite, and Nonprofit licenses. To get started, purchase your Gravity Forms license today.

If you want to keep up-to-date with what’s happening on the blog sign up for the Gravity Forms newsletter!