Clover vs Square: Full comparison of pricing and features

Trying to choose between Clover vs Square as your business’s POS system and/or payment processing solution?

Picking a POS system is a big decision, so you’ll want to try to get it right from day one. To help you make the best choice, we’re going to compare Square vs Clover so that you can understand how these two services are similar and different.

We’re not going to pick a single “winner”. Instead, we’ll just compare and contrast different areas such as the services offered, pricing, payment processing rates, region availability, and more.

By the end, you’ll hopefully have the information you need to make the best decision for your unique business.

Let’s get into it…

Square promotion – free processing

Gravity Forms and Square have teamed up to offer an exclusive promotion for new Square customers — enjoy free processing fees for up to 180 days!

Here’s how it works:

- Free Payment Processing – Get $3,000 in credit card transactions processed for free within your first 180 days. After that, standard Square fees apply.

- $20 Off Square Hardware – Receive a $20 discount on Square hardware once you sign up.

To take advantage of this promotion, simply sign up for a Square account using this link and start processing payments with no extra fees.

What can you do with Square and Clover?

Both Clover and Square have many different features, so we think it’s useful to start off our comparison by talking about what exactly you can do with each service.

Square

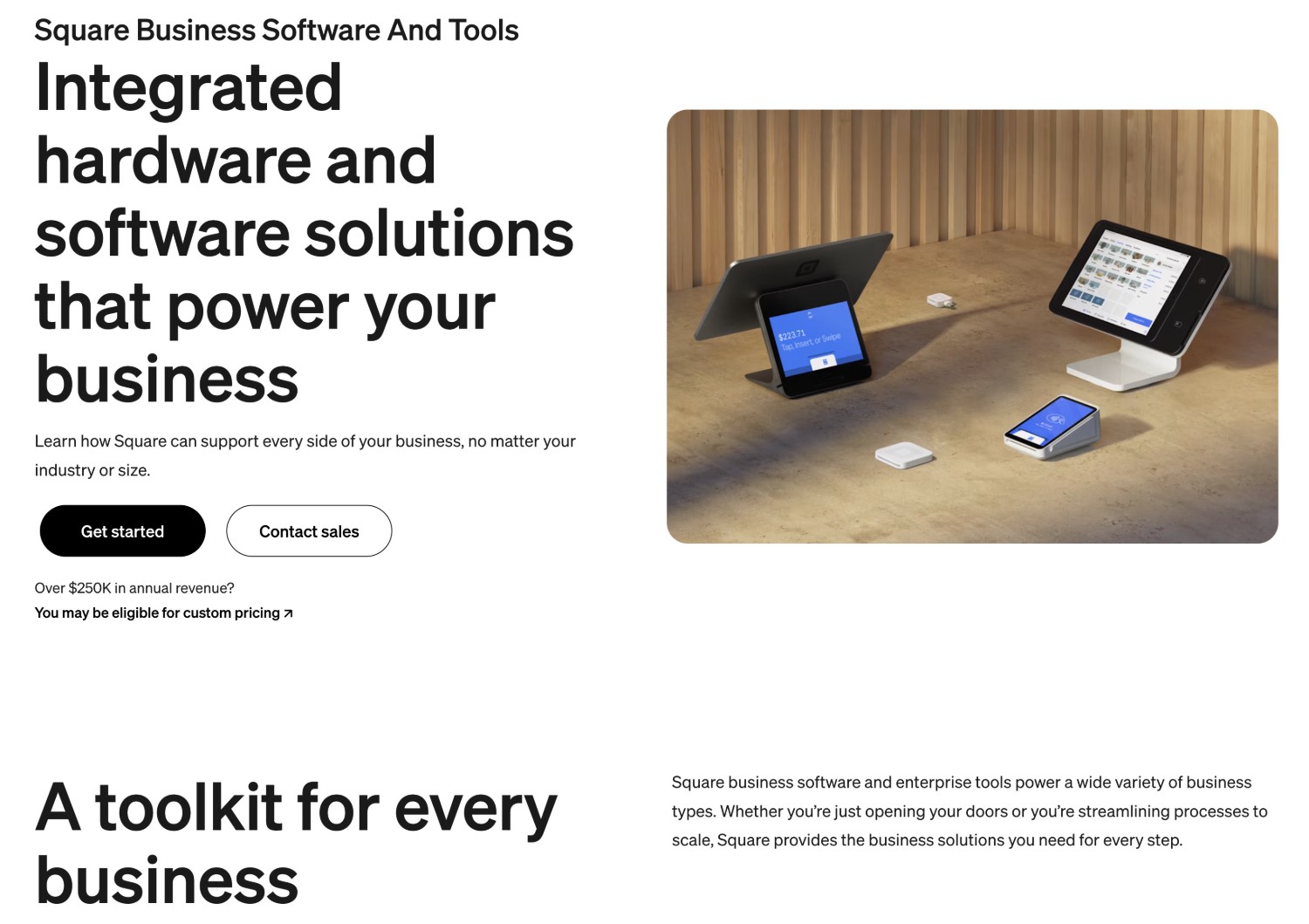

There are three high-level parts to what Square offers, though there’s obviously a lot of smaller details within each area:

- Payment processing and financial services – Square can help you process card payments and other types of payments, along with offering other types of financial services that can help your business.

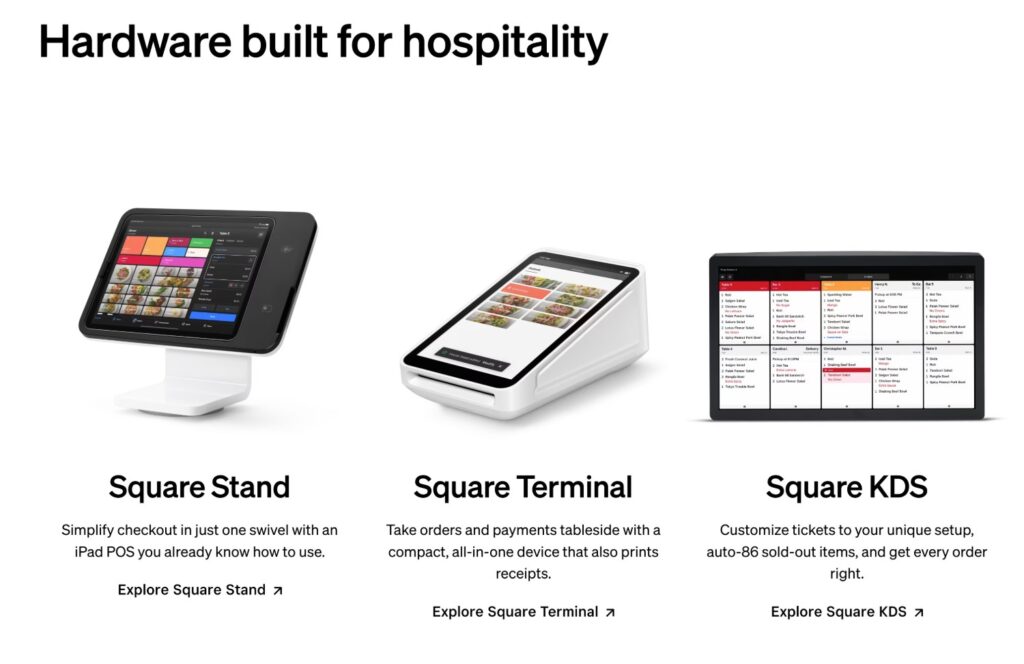

- Hardware – For physical businesses, Square offers physical hardware that you can use to process in-person payments and manage your business. These can include full POS systems and kitchen display units, as well as smaller handheld card readers.

- Software – Square offers software that can help you run your business, including software for your POS system, inventory management, appointment management, payroll, employee scheduling, and lots more.

Depending on your business, you might use all three parts of Square or just some of them.

For example, if you have a WordPress website and you just want to accept online payments, you might not need Square’s software. Instead, you could just use something like the Gravity Forms plugin to integrate Square’s payment processing functionality into your website.

On the other hand, if you’re running a restaurant or retail business, you might utilize everything that Square offers:

- You could use Square’s hardware to accept in-person payments that are processed by Square.

- You could use Square’s software to manage important parts of your business, including customer-facing interfaces and backend administration.

Square offers a lot of different software tools for all different types of businesses, including food and beverage, retail, beauty, services, appointment-based businesses, and more.

Here are some of the most notable software features, though this is not a complete list:

- Appointment booking – Square Appointments can work as a booking system for appointment-based businesses such as salons, spas, equipment rental, coaching, etc.

- Payroll and shift management – You can also improve your backend employee management with tools like Square Payroll (payroll management) and Square Shifts (employee scheduling).

- Marketing tools – You can access tons of marketing tools including email marketing, customer relationship manager (CRM), loyalty programs, gift cards, and more.

You can check out all of Square’s software tools here.

In addition to these software tools, Square also offers financial services that go beyond payment processing, including banking and loans.

Clover

Clover also covers the same three parts as Square, though many of the features will differ within each:

- Payment processing – Clover was acquired by Fiserv in 2019, which helps it offer its own payment processing services via Fiserv.

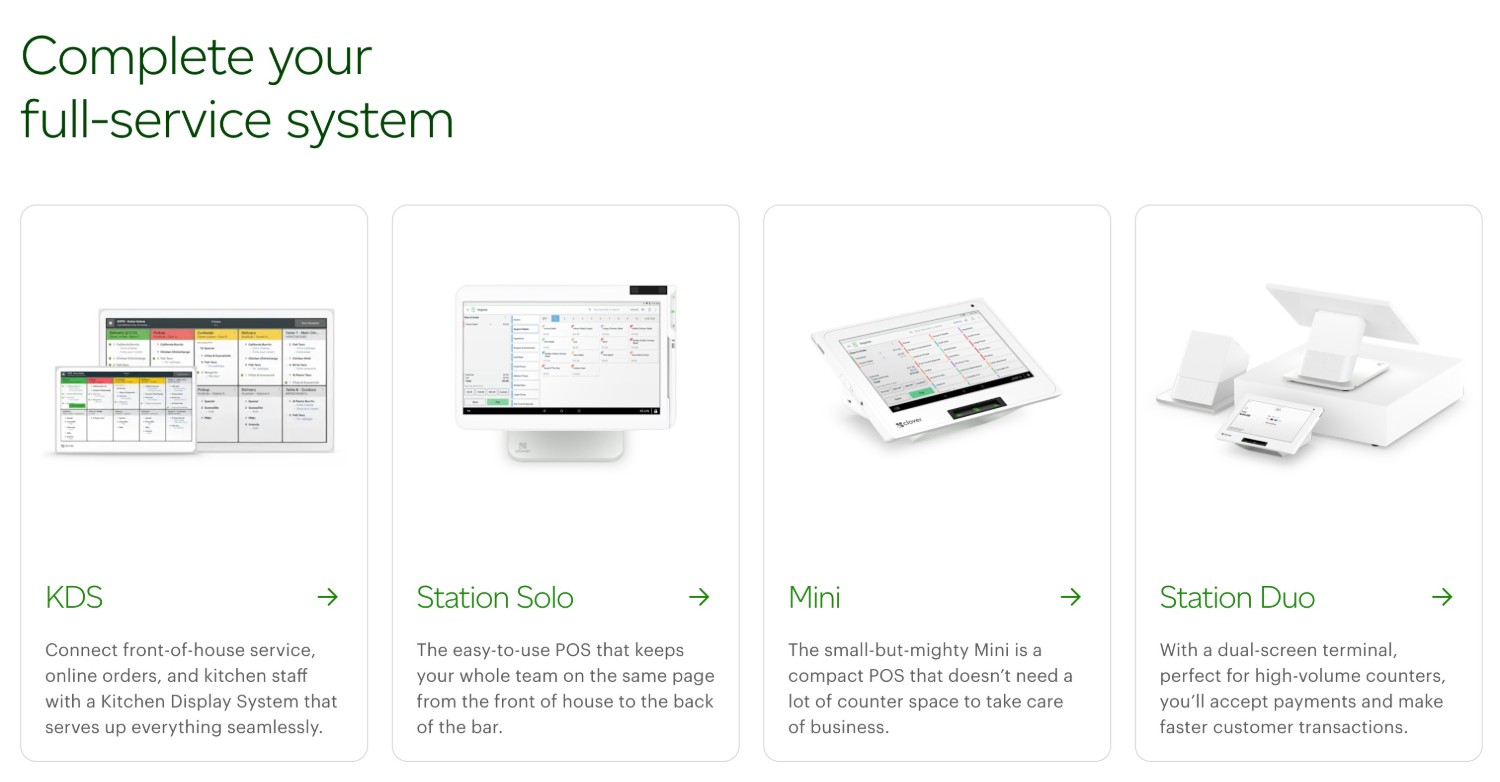

- Hardware – Clover offers a variety of physical hardware, including small handheld card readers, more robust stations, and a kitchen display system.

- Software – Clover has a variety of software tools, including tools for point of sale, inventory management, employee management, and more.

Whereas Square offers a more a la carte approach to letting you choose what tools you use, Clover assumes that you’ll be using the whole package to run your business.

That is, you’re going to be using Clover’s POS software and other tools to accept in-person payments using Clover’s physical hardware.

If you’re just looking for something to let you accept online payments via your WordPress website, Clover is probably not the right fit, whereas that’s something Square does well.

Within its software, Clover offers a lot of tools for businesses spanning restaurants, services, and retail industries. You can access backend tools to help you run your business, including inventory management and employee management (shift management and an optional payroll add-on).

Clover’s POS also includes features to help you connect with customers and market your business, including gift cards, loyalty programs, and other customer engagement tools.

Pricing, rates, and notable fees

Next, let’s talk about the different pricing options and fees at Square vs Clover.

There are a few main buckets of things that you might need to pay for:

- Hardware – The physical hardware that you need if you want to accept in-person payments.

- Software – The software to help you manage your menu/inventory, orders, etc.

- Payment processing fees – The fees to accept card payments, along with other potential fees such as chargeback fees for disputed payments.

These pricing details are correct at the time of writing. Let’s go through them…

Hardware and software fees

When it comes to hardware and software fees, Clover’s prices are generally higher than Square’s prices. However, there are also feature differences within the software, so we encourage you to do the math for your business’s specific feature needs.

Clover

Clover uses a subscription approach where you pay one monthly fee for access to both the POS software and the hardware that you need for in-person payments.

Clover has separate plans for six different business types. Within each business type, there are multiple pricing tiers.

For the plans, you generally have two options:

- Sign a 36-month contract with no setup fees and a fixed price over all 36 months. However, if you want to cancel the contract early, you will need to pay a termination fee.

- Pay a one-time setup fee to purchase the hardware outright and then a smaller monthly fee. You can cancel at any time without a termination fee.

Here are the starting prices for six different business types:

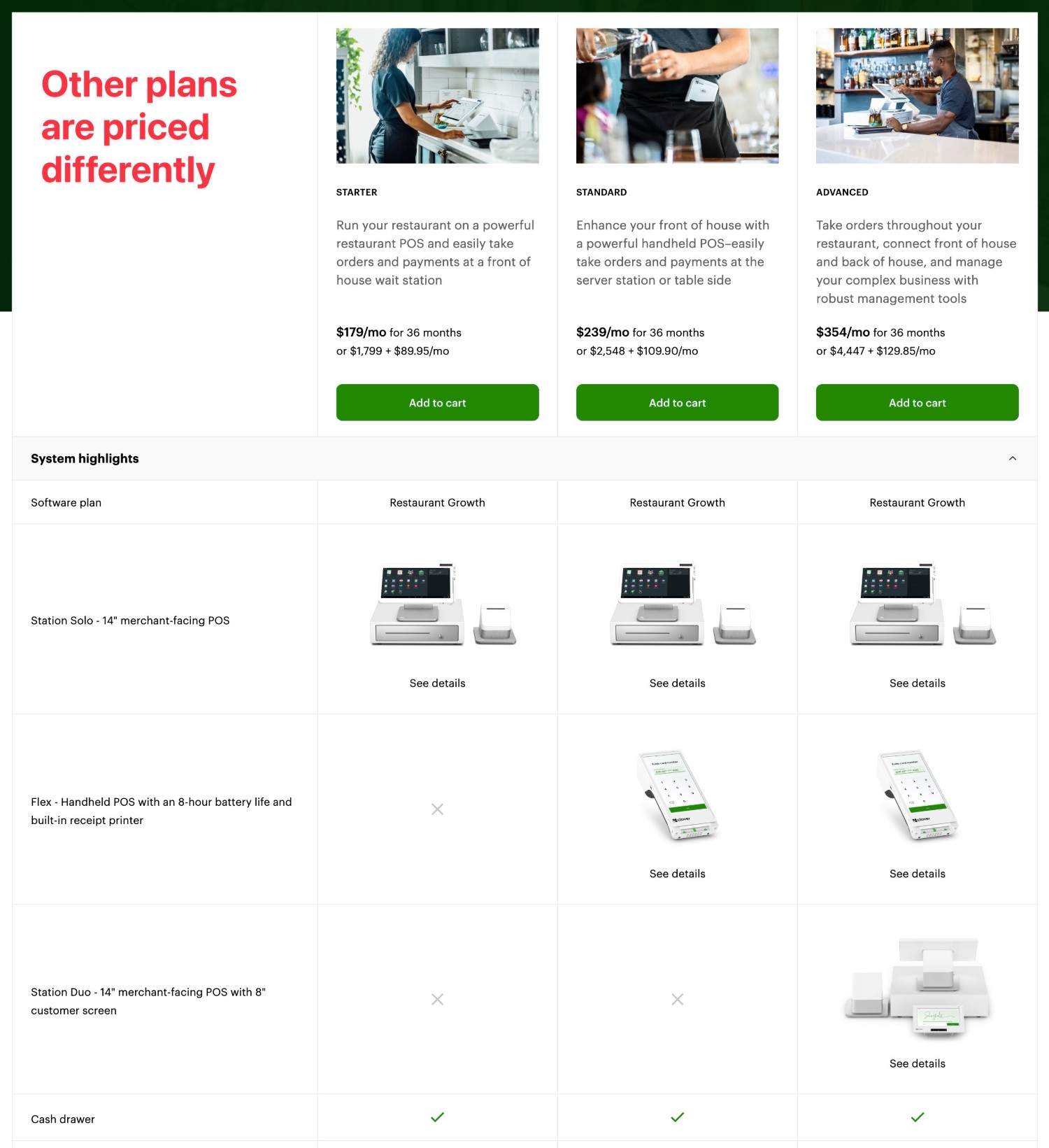

- Full service dining – Paid plans start from $179 per month for 36 months OR $1,799 + $89.95 per month.

- Quick-service restaurant – Paid plans start from $135 per month for 36 months OR $849 + $89.95 per month.

- Retail shops – Full-service paid plans start from $180 month for 36 months OR $1,899 + $84.95 per month. There’s also a cheaper handheld option from $16 per month for 36 months or $349 one time.

- Professional services – Full-service paid plans start from $125 per month for 36 months OR $749 + $84.95 per month. There’s also a cheaper web-only option that costs $14.95 per month.

- Personal services – Full-service paid plans start from $130 per month for 36 months OR $849 + $84.95 per month. There’s also a cheaper handheld option from $16 per month for 36 months or $349 one time.

- Home & field services – Full-service paid plans start from $199 + $14.95 per month. There’s also a cheaper web-only option that costs $14.95 per month.

Again, if you choose the 36-month contract pricing and want to end your contract early, you might need to pay a contract termination fee that can be $500+, according to user reports. This is notable because Square does not use long-term contracts or early termination fees on any of its plans.

For an example of the different pricing tiers, here are Clover’s pricing plans for full-service restaurant systems:

Square

Square generally gives you more flexibility on pricing, with no long-term contracts, no setup fees, and no cancellation fees.

What you need to pay for Square’s software and hardware will depend on the exact needs of your business. There are a few different scenarios:

- If you only want to accept online payments and you don’t need Square’s hardware, you don’t need to pay anything. You can just create a free Square account and start accepting online payments – the only thing you’ll pay is the card processing fees (more on those later).

- If you want to accept in-person payments but you DON’T need Square’s software, you can purchase Square’s payment hardware directly for a one-time fee. You would then just pay the card processing fees for accepting payments.

- If you want to use Square’s business software and accept in-person payments, Square offers monthly plans that include both the hardware and software for one rate. There’s also a free tier that lets you get started without paying anything.

Despite not having a setup fee, Square does not lock you into long-term contracts and there are no cancellation fees on any plans. This gives you more flexibility if your business needs ever change.

For a one-time hardware purchase, the price will depend on what hardware you want to use:

- Square Reader for magstripe – free

- Square Reader for chip and contactless payments – $59

- Square Stand – $149 (you’ll also need your own iPad)

- Square Kiosk – $149 (you’ll also need your own iPad)

- Square Terminal – $299

- Square Register – $799

For the subscription plans, the price will depend on what type of business you’re running:

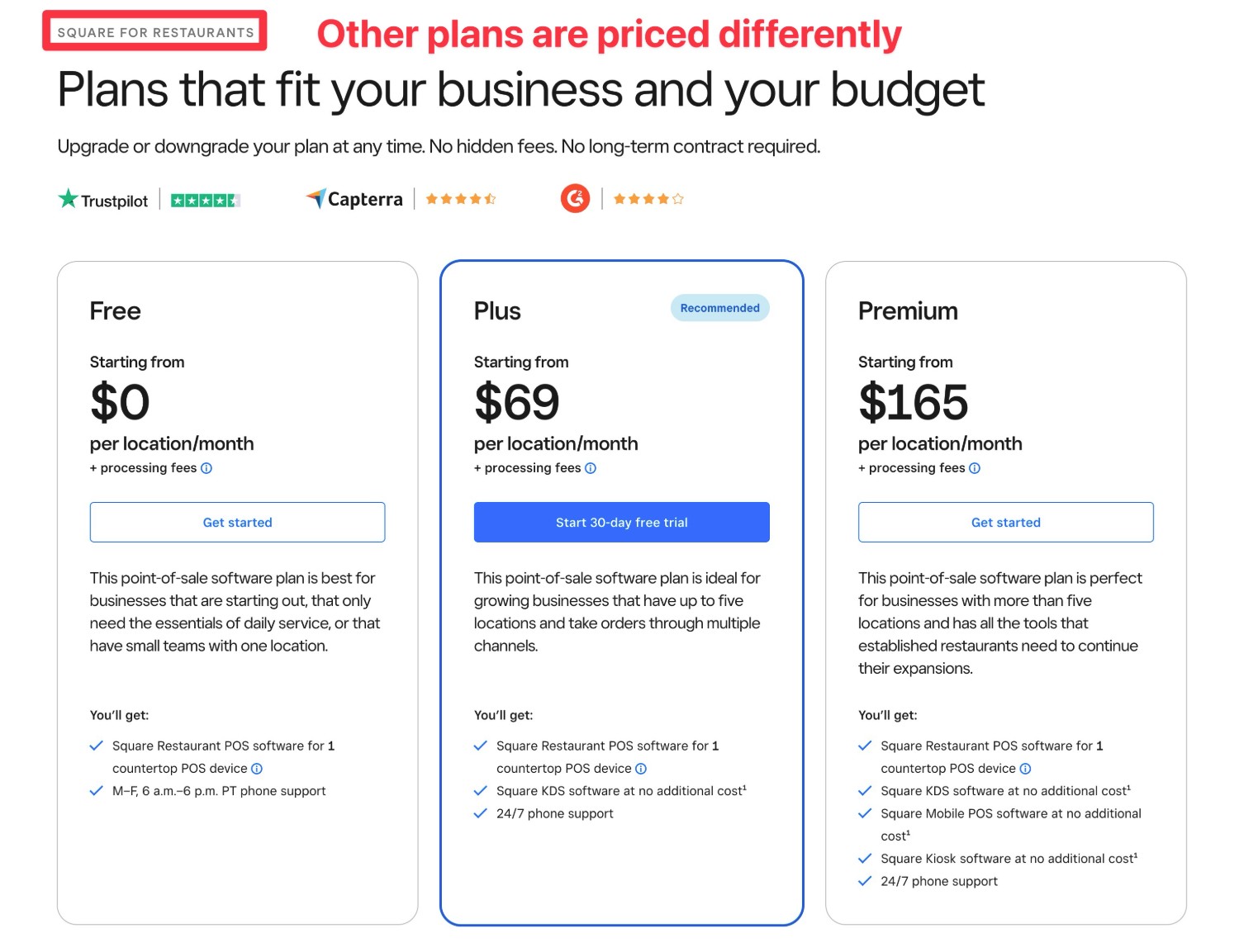

- Restaurants – Free plan to start. Paid plans from $69/month/location.

- Retail – Free plan to start. Paid plans from $89/month/location.

- Appointments – Free plan to start. Paid plans from $29/month/location.

Here’s an example of Square’s restaurant pricing:

Card processing fees

If you want to accept card payments, you’ll also pay a processing fee for each transaction.

The exact rate that you’ll pay can depend on a few variables, including the type of payment (e.g. card present vs non-card present transactions), your plan with Square/Clover, and potentially any custom rates that you’ve negotiated.

To give you an idea of what you might pay, here are each service’s published rates for card payments within the USA

Clover processing rates (USA):

- Card present transactions – 2.6% + $0.10, 2.5% + $0.10, or 2.3% + $010 (depending on the plan you have)

- Non-card present transactions (e.g. keying in a customer’s credit card manually) – 3.5% + $0.10

Square processing rates (USA):

- Card present transactions – 2.6% + $0.15

- Non-card present transactions – 3.5% + $0.15

- Online payments – 2.9% + $0.30

- Invoices or Square Payment Links – 3.3% + $0.30

If your business does more than $250,000 in processing per year, you can also talk to Square’s sales team to negotiate a custom rate.

Supported countries and currencies

Both Clover and Square offer full support within the USA and Canada. However, the two have different regional support outside of that.

Clover

Currently, Clover supports 11 different countries, though not all features and tools are available in all regions (check here for region-specific features):

- USA

- Canada

- UK

- Australia

- Ireland

- Austria

- Germany

- Netherlands

- Argentina

- Brazil

- Mexico

Clover’s support for Latin America is unique, as Square has not expanded to any of those regions yet.

Square

Currently, Square supports businesses and payments in eight different countries and local currencies:

- USA

- Canada

- UK

- Australia

- Japan

- Ireland

- France

- Spain

Square’s support for Japan, France, and Spain is unique, as Clover hasn’t expanded to those countries yet.

WordPress and Gravity Forms Integration: Square vs Clover

If you’re searching for a payment solution that you can use with Gravity Forms on your WordPress website, Square is probably the better option.

There are some third-party plugins that can help you display your Clover inventory on your WordPress website. However, for the most part, Clover doesn’t really integrate that tightly with WordPress.

Alternatively, you can easily integrate Square into WordPress using the Gravity Forms plugin and its Square Add-On. You’ll be able to access the following features:

- Create WordPress payment forms that you can include on any part of your site. You could charge a fixed price for everyone who uses the form or adjust the price based on each user’s choices, which lets you use it for lightweight ecommerce solutions.

- Accept one-time payments or set up recurring subscriptions. For subscriptions, you’ll be able to fully customize the payment period, including setting up payment plans.

- Manage payments from your WordPress dashboard. In addition to seeing payment data, you’ll also be able to refund payments and manage users’ subscriptions from your WordPress dashboard.

- Integrate payment forms with other WordPress functionality. For example, you could use Square to charge people to register for your WordPress website or submit content (such as submitting a job posting to your WordPress job board website).

If you want to use Square with WordPress and Gravity Forms, you can purchase the Gravity Forms Pro, Elite or Nonprofit license to access the Square Add-On.

As mentioned, Gravity Forms and Square are also currently offering a special deal for new Square users. If you’ve never signed up for Square before and you register for your account using this link, you’ll get free payment processing on up to $3,000 in transactions within the first 180 days, along with $20 off any Square hardware.

Start accepting payments today

Overall, there are both similarities and differences between Clover and Square. Choosing the best POS and payment processor for your situation will really just come down to the specific hardware and software functionality that you need, the physical location of your business, your budget, and potentially your desired payment processing rates.

While both offer robust in-person payment solutions, Square is probably the best option if you want to integrate a payment solution into your WordPress website.

With Gravity Forms and the Gravity Forms Square Add-On, you can integrate Square payments into any of your WordPress forms, including support for both one-time and subscription payments. All you need to do is purchase the Gravity Forms Pro, Elite or Nonprofit license.

And if you need more info on taking WordPress payments with Square, we’ve also compared Square with some other popular solutions, including Square vs Toast, Square vs Stripe, and Square vs PayPal.

If you want to keep up-to-date with what’s happening on the blog sign up for the Gravity Forms newsletter!